Getting Back On The Road

The Vehicle Transfer After Death Hub

When a vehicle owner passes away, their car, truck, or other vehicle must be legally transferred to a new owner. The process depends on factors such as joint ownership, Transfer-on-Death (TOD) titles, probate requirements, and outstanding loans. State laws vary, and some transfers may require court approval. This guide explains the steps for transferring a vehicle after death, helping heirs and executors navigate legal, financial, and DMV requirements.

Key Things To Know

Ownership Type Matters: Jointly owned vehicles may automatically transfer, while solely owned vehicles often require probate or a court order.

- Transfer-on-Death (TOD) Titles Simplify the Process: If the deceased designated a TOD beneficiary, probate is usually not required.

- State Laws Vary: Some states require an estate settlement before vehicle transfers, while others allow direct transfers with minimal paperwork.

- Loans and Liens Must Be Addressed: If the vehicle has an outstanding loan, the new owner may need to refinance or pay it off before taking ownership.

- DMV Title Transfers Are Required: Regardless of how the vehicle is inherited, the new owner must update the title with the state DMV before legally driving the car.

Checklists, Guides, & Resources

Buried in Work offers a variety of checklists, guides, and other resources. Below are some of the most popular ones related to this information hub.

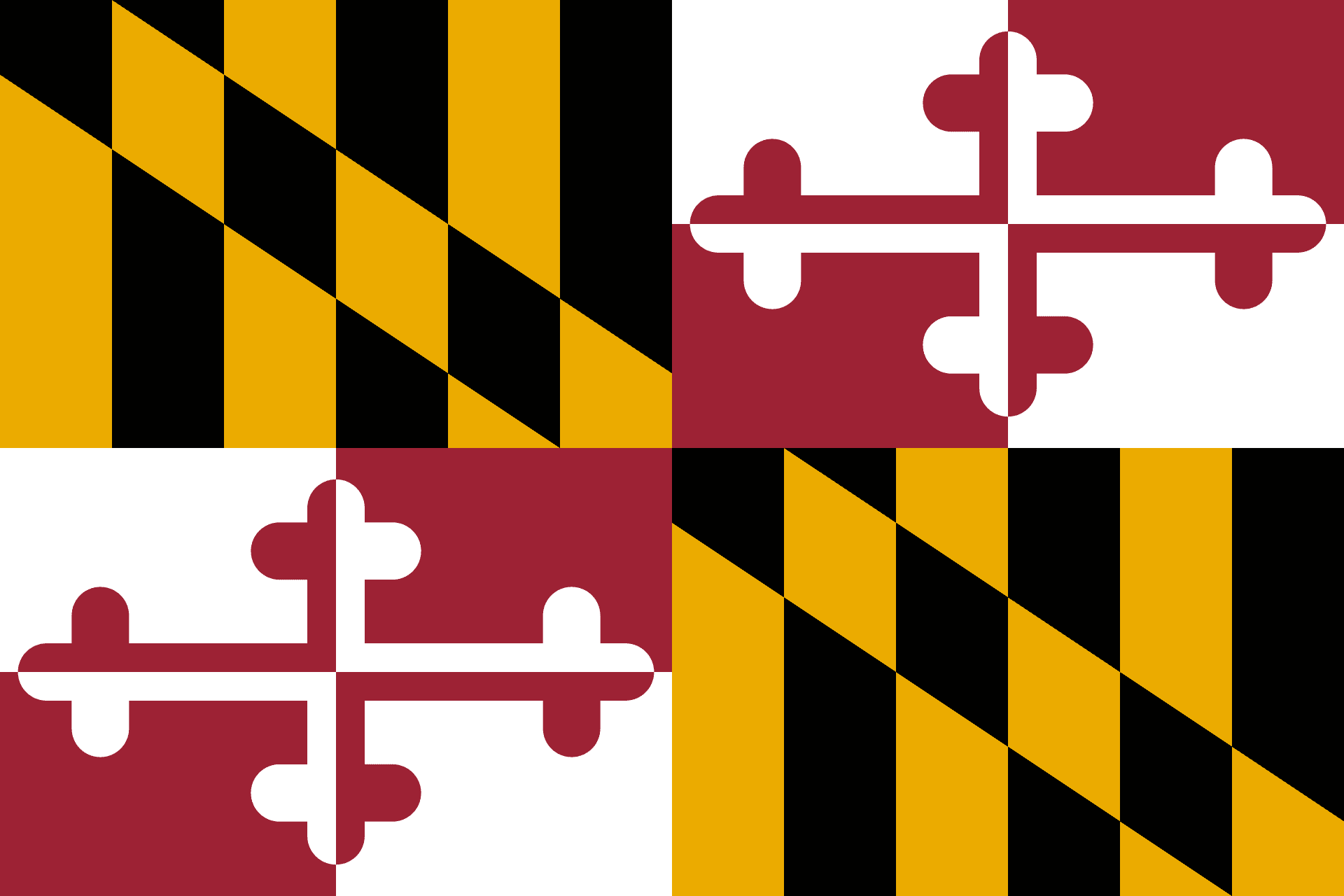

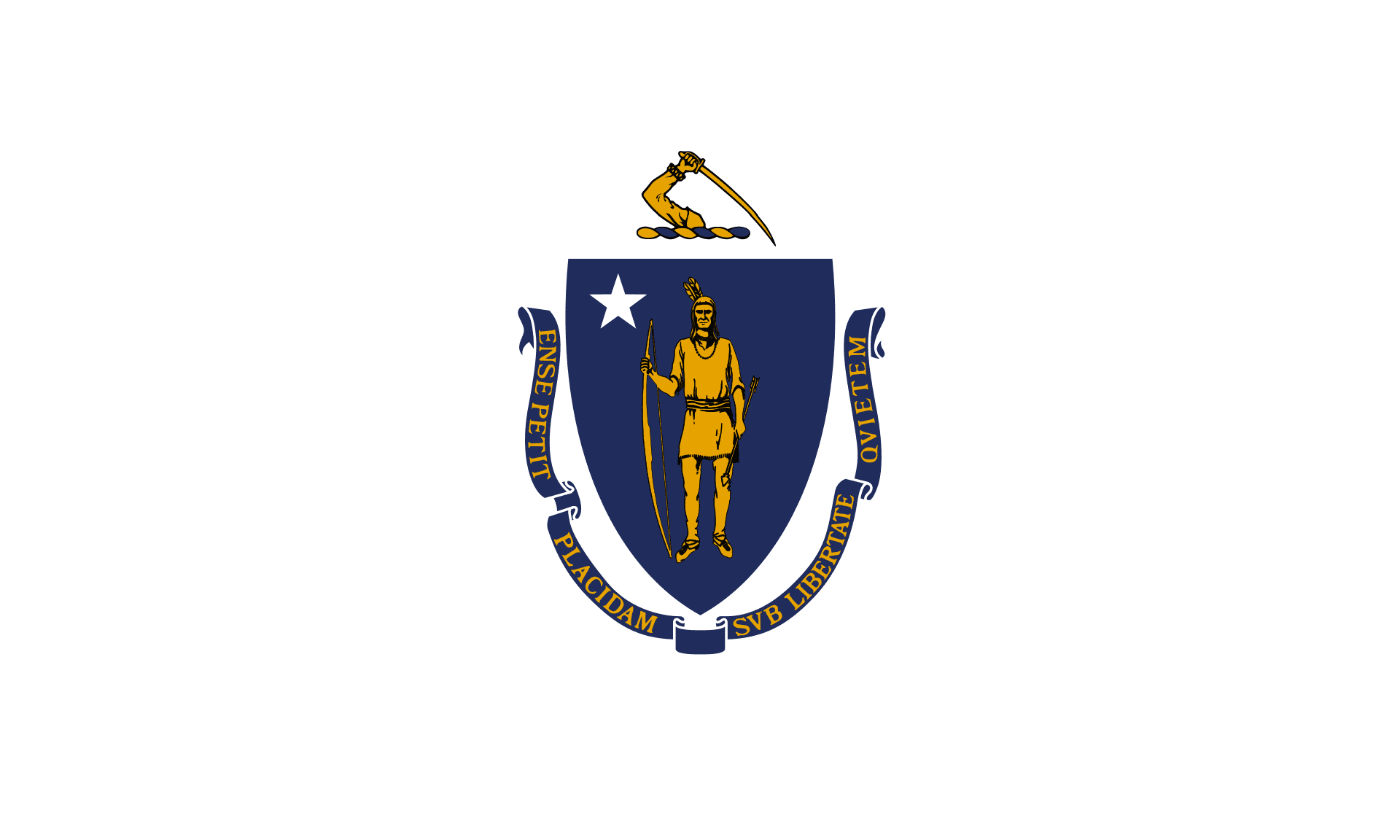

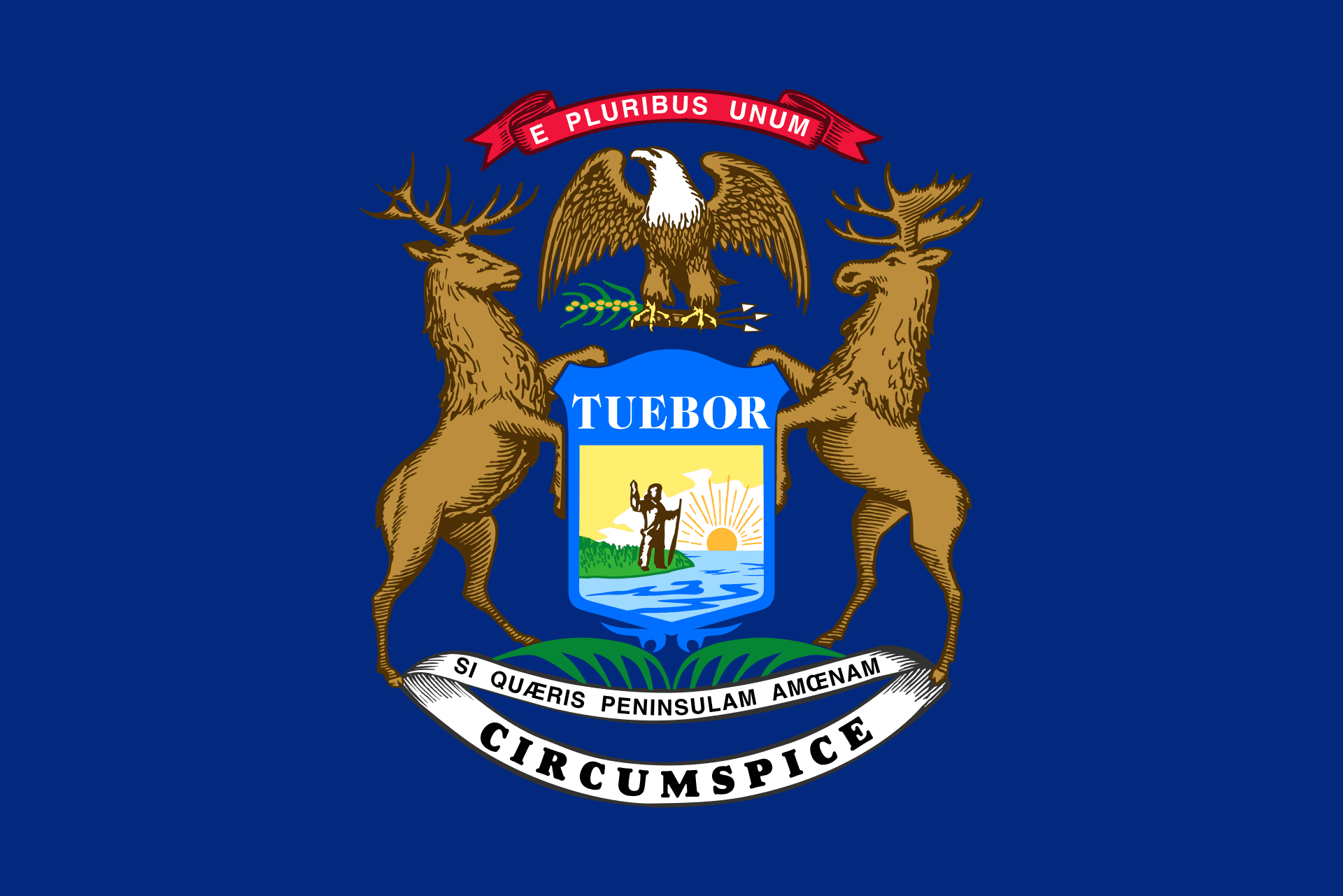

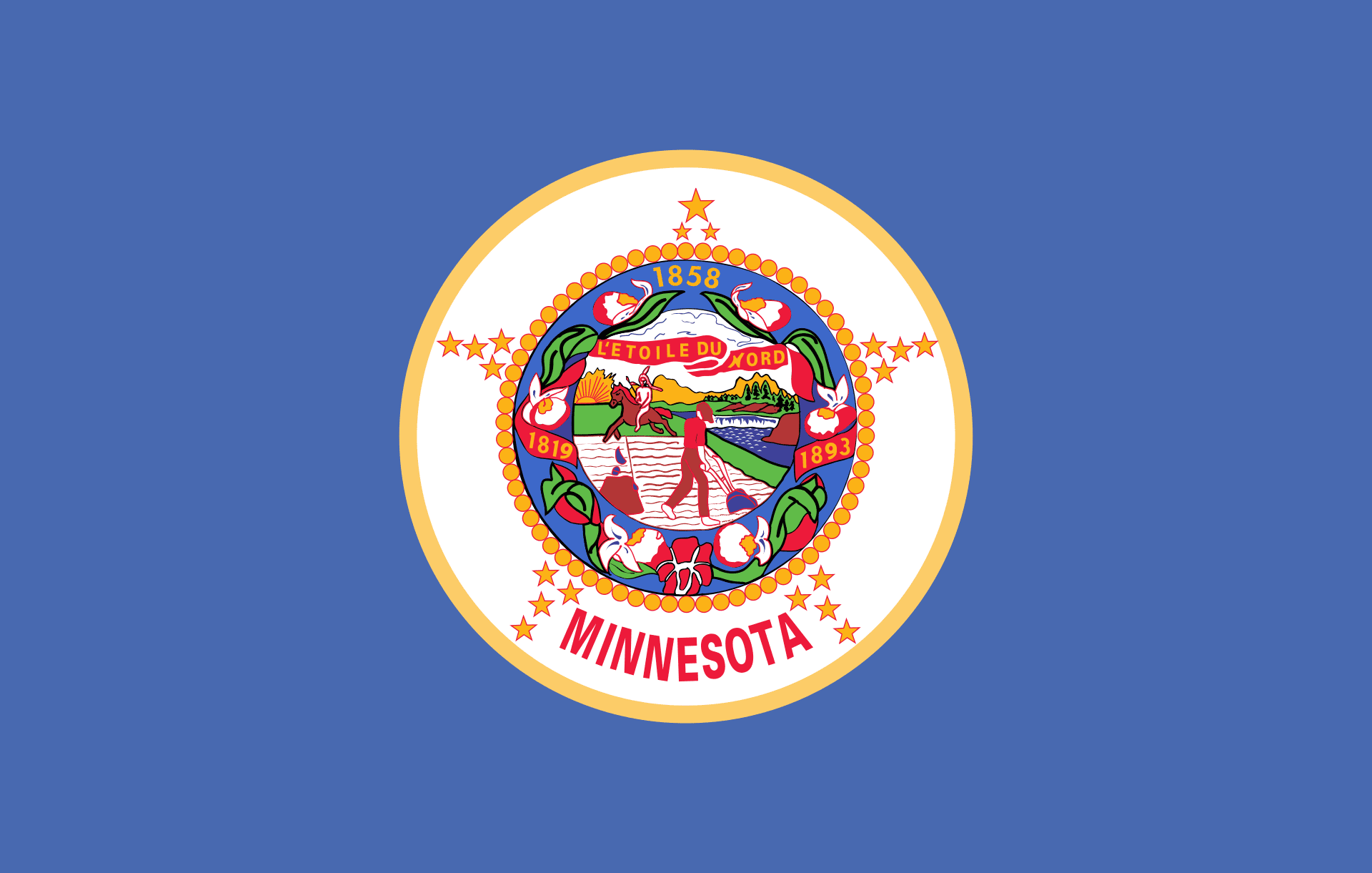

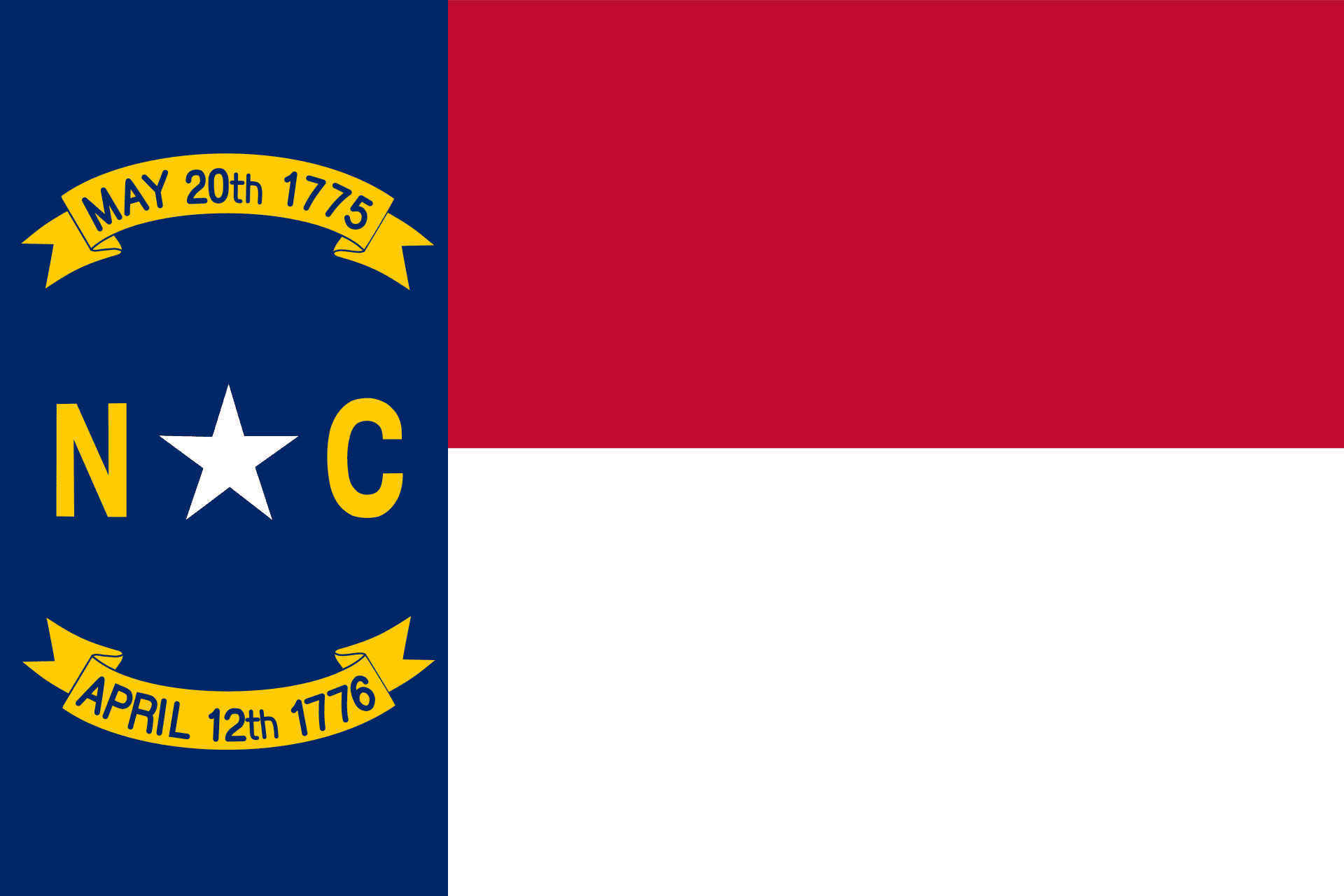

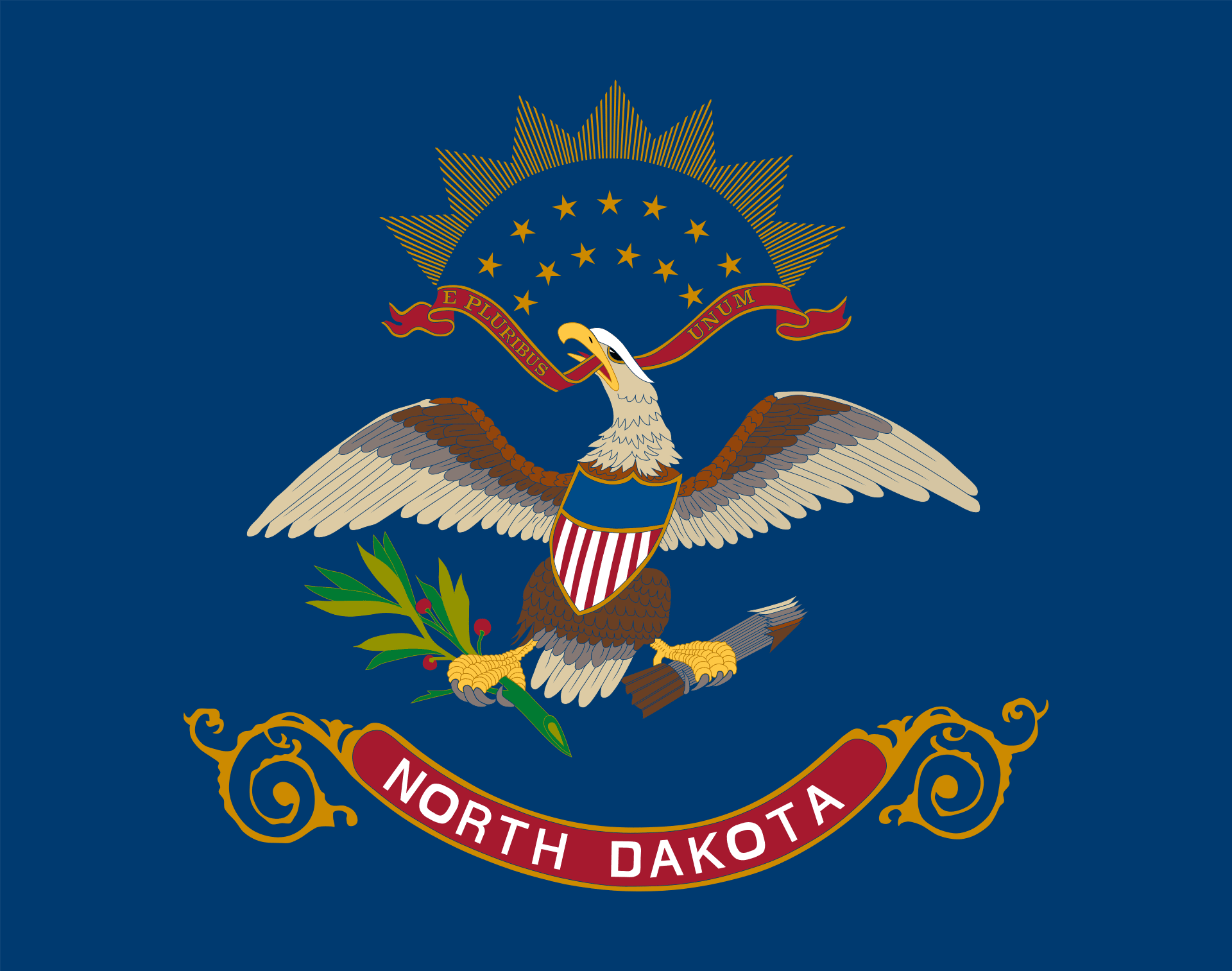

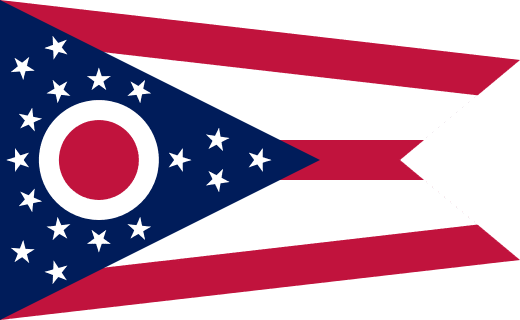

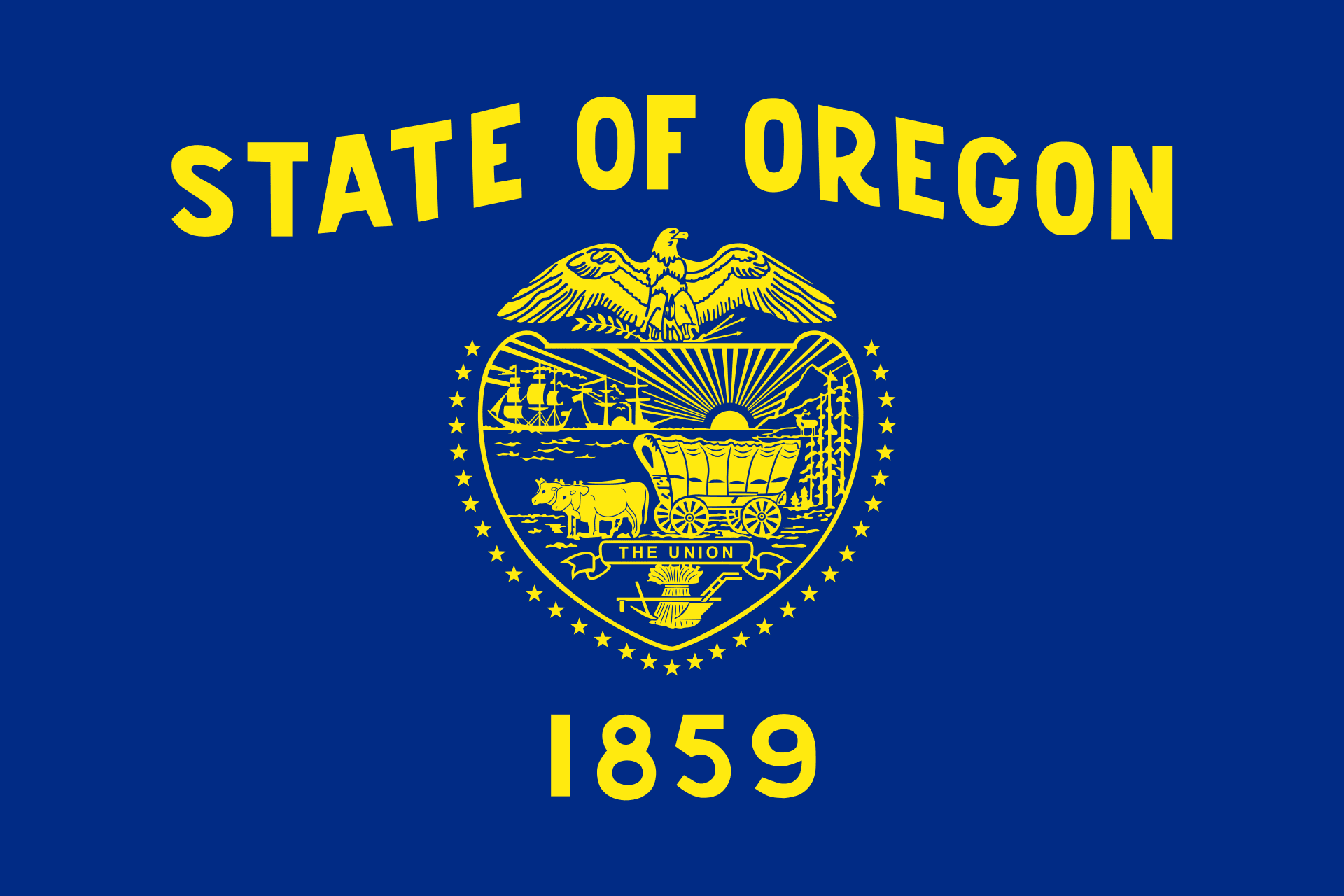

State Specific Instructions

Frequently Asked Questions

Transferring a vehicle after the owner's death can be a complex process, depending on factors like ownership type, state laws, and probate requirements. Whether you're an executor managing an estate, a family member inheriting a vehicle, or someone handling a Transfer-on-Death (TOD) title, understanding the rules can help avoid delays and legal complications.

Below, we’ve answered the most common questions about title transfers, DMV procedures, taxes, and financial considerations to help you navigate the process smoothly.

Ownership & Transfer Methods

State-Specific Rules & DMV Process

Taxes, Fees & Financial Considerations

Special Cases: Selling, Gifting, & Donating Vehicles

Disclaimer: The information provided on this website and by Buried in Work is for general informational purposes only and should not be considered legal advice. Please consult with a qualified attorney or subject matter expert for advice specific to your situation.