Understanding Social Security Survivor Benefits & How They Work

The Social Security Survivor’s Benefits Hub

Losing a loved one is difficult, and navigating the financial impact can add stress during an already challenging time. Social Security survivor benefits provide financial support to eligible family members of deceased workers who paid into the Social Security system. These benefits can help surviving spouses, children, and sometimes even dependent parents maintain financial stability.

This hub covers who qualifies for survivor benefits, how they are calculated, and what steps you need to take to claim them.

Key Things To Know

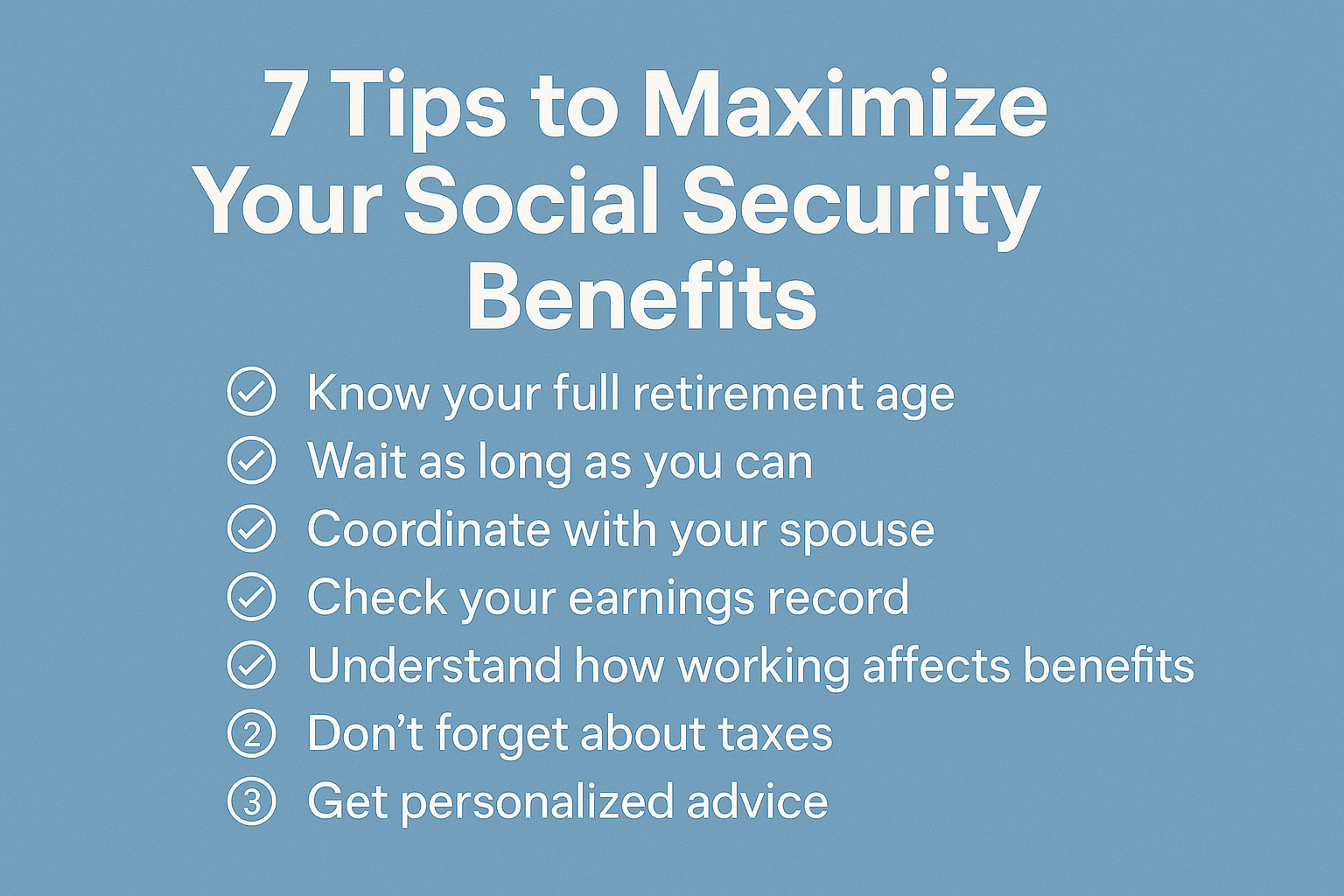

Social Security survivor benefits are available to certain family members of a deceased worker who earned enough work credits. Understanding who qualifies and how benefits are calculated can help ensure you or your loved ones receive the financial support they are entitled to.

- Surviving spouses can claim benefits as early as age 60 (or age 50 if disabled), but waiting until full retirement age results in a larger monthly payment.

- Children under 18 (or up to 19 if still in high school) may qualify for benefits. If the child is disabled, they may continue receiving benefits into adulthood.

- Dependent parents aged 62 or older may be eligible for benefits if they relied on the deceased worker for financial support.

- Survivor benefits do not reduce your own Social Security benefits. If you qualify for both survivor benefits and your own retirement benefits, you may be able to switch between them at different times.

- Remarrying before age 60 (or 50 if disabled) may affect eligibility. However, remarrying after age 60 does not impact survivor benefits.

- A one-time death benefit of $255 is available to a surviving spouse or child. This small lump sum payment is separate from monthly benefits.

Checklists, Guides, & Resources

Buried in Work offers a variety of checklists, guides, and other resources. Below are some of the most popular ones related to this information hub.

Find A Service Provider Near You

Need professional assistance? Use our directories to find trusted service providers near you who specialize in estate planning, end-of-life organization, and related services.

Articles

Frequently Asked Questions

Social Security survivor benefits can be an essential financial resource for families who lose a loved one. Knowing the eligibility rules, application process, and potential benefits can help you make informed decisions.

Disclaimer: The information provided on this website and by Buried in Work is for general informational purposes only and should not be considered legal advice. Please consult with a qualified attorney or subject matter expert for advice specific to your situation.