Don’t Leave Money on the Table

The Maximizing Your Social Security Benefits Information Hub

You’ve been paying into Social Security your whole working life. Now it’s your turn to get paid, but how and when you claim can make a big difference. Whether you’re years away from retirement or already eligible, this guide will help you understand the rules, avoid common mistakes, and make choices that work for your life, your income, and your legacy. Because let’s face it: no one wants to accidentally shortchange their future self.

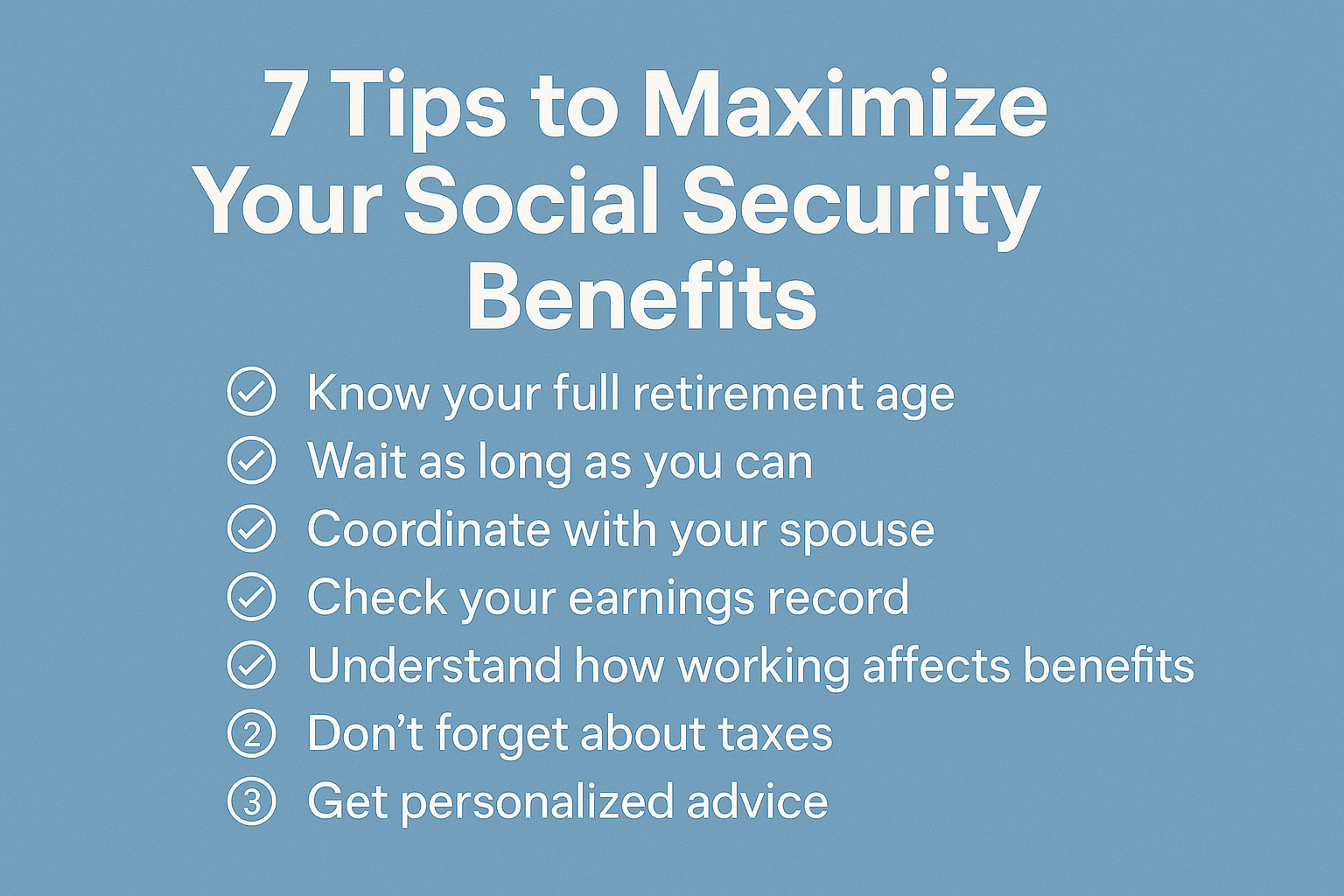

Key Things To Know

Claiming Social Security isn’t just about hitting a certain age. It's about making smart, informed choices that reflect your income, goals, and family situation.

- Timing matters: Claiming early can reduce your benefit for life, while waiting up to age 70 increases your monthly amount significantly.

- Full retirement age varies: It’s not 65. For most people today, it's between 66 and 67. The age you file determines whether you get a reduced, full, or increased benefit.

- Spousal benefits can boost your income: You may be eligible to claim based on your spouse’s work record, even if you didn’t earn enough credits yourself.

- Divorced? You might still qualify: If your marriage lasted at least 10 years and you haven’t remarried, you may be eligible for benefits on your ex’s record.

- Working affects your benefits: If you earn too much before full retirement age, your Social Security checks could be temporarily reduced.

- Yes, Social Security can be taxed: Depending on your income, up to 85% of your benefit may be subject to federal taxes.

- There’s a breakeven point to consider: Waiting to claim can pay off over time, but it depends on how long you live and how you plan to use your income.

- Get a personalized strategy: Every household is different. A thoughtful claiming approach can mean more money for you and your loved ones over time.

Articles

Frequently Asked Questions

Social Security can feel complicated, but the most common questions have surprisingly straightforward answers. Here’s what people like you often ask.

Disclaimer: The information provided on this website and by Buried in Work is for general informational purposes only and should not be considered legal advice. Please consult with a qualified attorney or subject matter expert for advice specific to your situation.