A strong estate plan starts here.

The Core Estate Planning Concepts Information Hub

Core estate planning documents are the foundation of protecting your wishes, your family, and your future. These are the essential tools that make sure the right people can step in when needed, without confusion or delays. No matter your age, family size, or financial situation, having these documents in place gives you control over what happens next.

Table of Contents

Key Things To Know

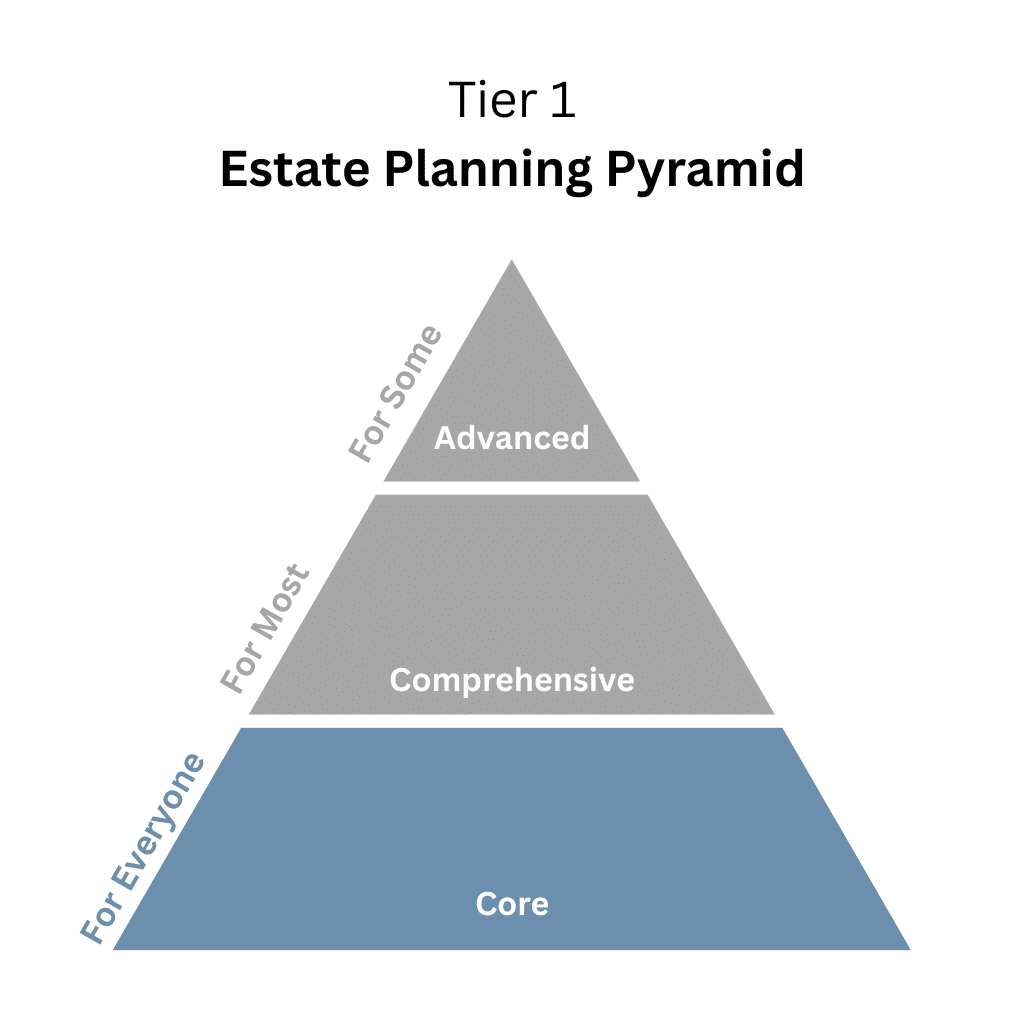

These core documents are not just paperwork. They are your voice, your decisions, and your protection when you need it most. They are the first step in Buried in Work's Estate Planning Pyramid.

- Every adult should have core documents in place: You do not need to be wealthy or retired. Core planning protects everyone.

- A will does more than pass down money: It names guardians for minor children, handles personal belongings, and sets clear instructions for your final wishes.

- Financial and medical powers of attorney are just as important as a will: They allow trusted people to act for you if you cannot, without needing a court order.

- Advance directives are not only for end-of-life care: They cover many important medical choices long before emergencies happen.

- Without core documents, someone else will decide for you: State laws will determine what happens to your finances, healthcare, and property if you leave no instructions.

- Updating is just as important as creating: Major life changes like marriage, divorce, having children, or moving states should trigger a review of your core documents.

Download the FREE Estate Planning Pyramid Core Documents Checklist

Design & build completely custom layouts

The Estate Planning Essentials Bundle provides a free estate planning summary and two key worksheets to help you organize and streamline your planning process. Whether you’re just getting started or trying to bring order to existing plans, these simple, practical tools will walk you through essential considerations.

Key Documents And Planning Tools

Below you will find the essential documents that every estate plan needs, along with quick links to learn more.

Last Will and Testament

What It Is

A will is a legal document that decides who inherits your property and who will manage your affairs after you pass away. It also allows you to name guardians for minor children and outline personal wishes.

Why It Matters

Without a will, state laws decide who gets your belongings and who handles your estate. Having a will gives you control, reduces confusion, and helps your family avoid unnecessary legal delays during an already difficult time.

Who It Is For

Every adult should have a will, especially if you have children, own property, or want specific people to inherit your belongings. It is one of the most important basic planning steps you can take.

Advance Directives (Healthcare Proxy or Medical Power of Attorney)

What It Is

Advance directives are legal documents that outline your medical treatment preferences and name someone you trust to make healthcare decisions for you if you are unable to speak for yourself. This usually includes a living will and a healthcare proxy (also called a medical power of attorney).

Why It Matters

Medical emergencies can happen unexpectedly. Without clear instructions or a trusted decision-maker, medical teams and family members may struggle with uncertainty during a crisis. Advance directives give you control over your care and ease the burden on loved ones by making your wishes clear ahead of time.

Who It Is For

Every adult should have advance directives, especially anyone who wants a trusted person to advocate for their healthcare choices and avoid default decisions being made by the state or distant relatives.

Financial Power of Attorney

What It Is

A financial power of attorney gives someone you trust the legal authority to manage your finances if you become unable to do so yourself. It can cover tasks like paying bills, handling investments, managing real estate, and filing taxes.

Why It Matters

Without a financial power of attorney, your family may have to go to court to get permission to manage your money during a crisis. Having this document in place avoids delays, legal costs, and uncertainty when help is needed most.

Who It Is For

Every adult should have a financial power of attorney, especially if they have income, savings, investments, or property that would need to be managed during an illness or emergency.

HIPAA Authorization

What It Is

A HIPAA authorization gives someone permission to access your private medical records and communicate with your healthcare providers. It ensures that trusted family members, friends, or caregivers can receive important updates about your condition if you cannot speak for yourself.

Why It Matters

Without a HIPAA authorization, doctors and hospitals may refuse to share medical information, even with close family members. Having this document avoids confusion, removes privacy barriers, and speeds up communication during medical emergencies.

Who It Is For

Every adult should have a HIPAA authorization, especially anyone with loved ones who may need to get medical information quickly during a crisis. It is especially important for college students, unmarried partners, and blended families.

Digital Legacy Instructions

What It Is

Digital legacy instructions tell your loved ones how to handle your online accounts, digital assets, and electronic information after you pass away or become incapacitated. This can include social media, email, banking apps, cloud storage, and cryptocurrency.

Why It Matters

Without clear instructions, your family may struggle to access important information or close accounts. Digital confusion can delay settling your affairs and sometimes cause emotional distress if online profiles remain unmanaged.

Who It Is For

Everyone who uses email, social media, online banking, or any digital services. Digital legacy planning is especially important for people who store important documents or assets online.

Key Contacts Log

What It Is

A key contacts log is a simple document that lists the important people and organizations your family might need to reach after your death or if you become incapacitated. It can include attorneys, financial advisors, insurance agents, healthcare providers, and close personal contacts.

Why It Matters

In an emergency, your loved ones should not have to dig through old paperwork or emails to find the right people to call. A key contacts log saves time, reduces confusion, and makes it easier to manage your estate and affairs quickly and respectfully.

Who It Is For

Every adult should create a key contacts log, especially if you work with professionals, manage complex assets, or simply want to make life easier for the people handling your estate.

Frequently Asked Questions

Still sorting through the basics? Here are common questions about the core documents that form the foundation of every strong estate plan.

Disclaimer: The information provided on this website and by Buried in Work is for general informational purposes only and should not be considered legal advice. Please consult with a qualified attorney or subject matter expert for advice specific to your situation.