A good plan is not just what you sign. It is what your family can actually find.

The Comprehensive Estate Planning Concepts Information Hub

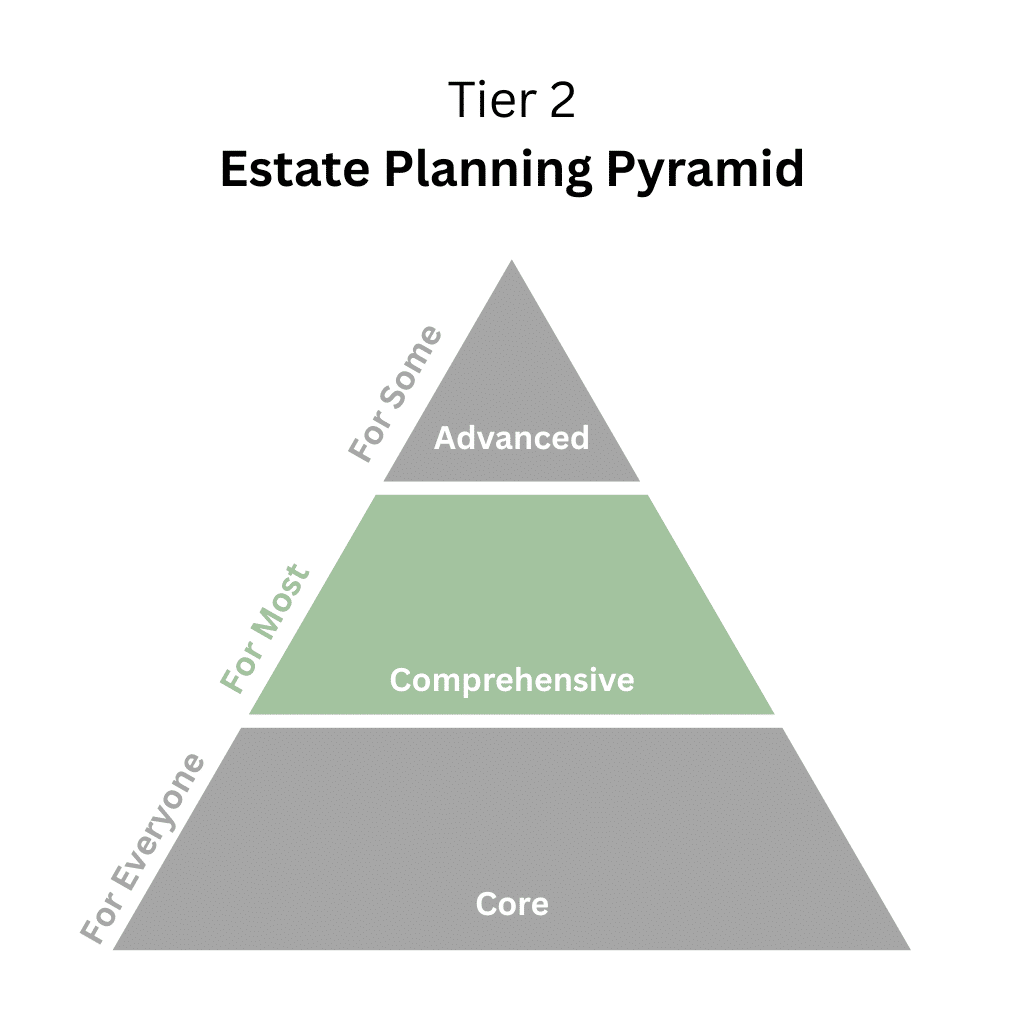

Comprehensive estate organization goes beyond basic legal documents. It is about making sure everything your family will need is easy to locate, easy to understand, and easy to act on. These tools add clarity and comfort to your planning, helping avoid stress, confusion, and unnecessary mistakes when it matters most.

Table of Contents

- Key Things To Know

- Key Documents And Planning Tools

- Asset Inventory

- Bank & Financial Accounts

- Payable On Death Beneficiary Designations

- Debts & Loans Inventory

- Ethical Will & Legacy Messaging

- Income & Recurring Bank Deposits

- Investments, Retirement Accounts, & Benefits

- Tax Records & History

- Final Resting Place Instructions

- Life Insurance Coverage Summary

- Pet Care Plan

- Estate Organization System

- Frequently Asked Questions

- Information Hub Feedback & Suggestions

Key Things To Know

Good estate planning does not end with a signature. It ends with peace of mind.

- Organization turns a good plan into a great one: Having documents is important. Making them easy to find and understand is just as critical.

- Small details make a big difference: Instructions about funeral wishes, asset locations, and key contacts save time, money, and conflict.

- Comprehensive planning is for every family: You do not have to be wealthy to benefit from better organization and clear instructions.

- Document location matters as much as document content: If your family cannot find what you created, it is like it does not exist.

- Your planning should be written for people, not just for courts: Clear instructions help loved ones take care of what matters without second-guessing or fighting.

Key Documents And Planning Tools

Below you will find the organizational tools that make your plan complete, clear, and easy for loved ones to follow.

Asset Inventory

What It Is

An asset inventory is a complete list of everything you own that has financial or sentimental value. This includes bank accounts, retirement plans, real estate, investment accounts, valuable personal property, and any business interests.

Why It Matters

Without a clear inventory, your family may struggle to find or claim your assets. Important accounts or property can easily be lost, forgotten, or tied up in long legal processes. An asset inventory makes it easier to settle your estate, distribute your belongings according to your wishes, and avoid unnecessary delays and stress.

Who It Is For

Everyone should create an asset inventory, especially those with multiple bank accounts, real estate, retirement savings, investment accounts, or valuable personal property that needs to be passed on or protected.

Bank & Financial Accounts

What It Is

A bank and financial accounts list records where you keep your money and investments. This includes checking accounts, savings accounts, credit unions, investment brokerage accounts, retirement plans, and any online banking platforms.

Why It Matters

Without clear information about your accounts, your family may face delays accessing funds or even lose track of important assets. Having a complete list makes it easier to manage your estate, close accounts, and distribute funds according to your wishes.

Who It Is For

Everyone should document their financial accounts, especially those who have multiple banks, online accounts, investment portfolios, or retirement plans that loved ones will need to access.

Payable On Death Beneficiary Designations

What It Is

A payable on death (POD) designation allows you to name a beneficiary who will automatically receive the balance of a bank account, retirement account, or investment without going through probate. It is a simple way to transfer certain assets directly to someone you choose.

Why It Matters

Without POD designations, accounts may get tied up in probate, delaying access and adding legal costs. Naming beneficiaries ensures a faster, smoother transfer of assets and can help avoid confusion or disputes.

Who It Is For

Anyone who holds money in bank accounts, investment accounts, or retirement plans should review and update their payable on death designations to match their current wishes.

Debts & Loans Inventory

What It Is

A debts and loans inventory is a list of what you owe, including mortgages, credit cards, personal loans, auto loans, student loans, and any other outstanding financial obligations.

Why It Matters

Without a clear list of debts, your family could miss important payments, face collections, or struggle to close your accounts properly. Organizing your liabilities helps ensure a smoother estate settlement and protects your credit and your estate’s value.

Who It Is For

Everyone with financial obligations should create a debts and loans inventory, especially those with mortgages, credit cards, personal loans, or other recurring debt that would need to be handled after death or incapacity.

Ethical Will & Legacy Messaging

What It Is

An ethical will, sometimes called a legacy message, is a personal document where you share your values, life lessons, hopes, and memories with your loved ones. It is not a legal document about assets, but a way to pass down wisdom and stories.

Why It Matters

Financial inheritances fade, but personal stories and values can guide families for generations. An ethical will gives your loved ones insight into who you are, what mattered to you, and the life experiences you hope they remember.

Who It Is For

Anyone who wants to leave more than just money behind. Ethical wills are especially meaningful for parents, grandparents, and anyone who wants to strengthen family bonds across generations.

Income & Recurring Bank Deposits

What It Is

An income and recurring deposits list tracks the money regularly coming into your accounts. This includes salaries, pensions, Social Security, investment dividends, rental income, and automatic deposits from other sources.

Why It Matters

Without a clear understanding of your incoming funds, your family could miss payments, disrupt benefits, or mishandle future deposits. A complete list helps ensure that income is properly managed, redirected, or closed out during estate settlement.

Who It Is For

Everyone with financial obligations should create a debts and loans inventory, especially those with mortgages, credit cards, personal loans, or other recurring debt that would need to be handled after death or incapacity.

Investments, Retirement Accounts, & Benefits

What It Is

This record keeps track of your financial investments, retirement savings plans, and employee or government benefits. It includes 401(k)s, IRAs, pensions, stock portfolios, annuities, and Social Security benefits.

Why It Matters

Without clear documentation, your family could lose access to important savings, miss benefit claims, or face delays settling your estate. A complete inventory makes it easier to transfer accounts, claim benefits, and protect the financial security you worked to build.

Who It Is For

Anyone with retirement savings, investments, or employee benefits should keep an updated record, especially if they have multiple accounts or receive benefits from past employers or government programs.

Tax Records & History

What It Is

Tax records and history include past federal, state, and local tax returns, as well as related documents like W-2s, 1099s, and property tax bills. They provide a financial snapshot that can help settle an estate and resolve final obligations.

Why It Matters

Access to past tax returns makes it easier to file final returns, address outstanding taxes, and verify income or asset histories. Missing tax documents can delay estate settlement, trigger audits, or create unnecessary legal hurdles for your family.

Who It Is For

Everyone should organize at least several years of recent tax records, especially those who own businesses, investment properties, or have complex financial situations.

Final Resting Place Instructions

What It Is

Final resting place instructions document your wishes for burial, cremation, human composting, body donation, or other memorial options. They give your family clear guidance about how you want to be laid to rest.

Why It Matters

Without clear instructions, loved ones are often left guessing about your final wishes during an emotional and stressful time. Writing down your preferences makes decisions easier, reduces conflict, and ensures your choices are respected.

Who It Is For

Everyone should leave final resting place instructions, especially those with specific cultural, religious, or personal preferences about how they want to be honored after death.

Life Insurance Coverage Summary

What It Is

A life insurance coverage summary lists all your active life insurance policies, including policy numbers, coverage amounts, beneficiaries, and where the original documents are stored.

Why It Matters

Without clear information, your family could overlook a policy or face delays in filing claims. A simple summary helps your loved ones access important benefits quickly and ensures that the financial protection you intended reaches the right people.

Who It Is For

Anyone with a life insurance policy, whether through work or purchased privately, should maintain a life insurance summary to make claim filing easier for their family.

Pet Care Plan

What It Is

A pet care plan outlines who should care for your pets if you become incapacitated or pass away. It can include your preferred caregivers, veterinary information, feeding routines, medications, and financial arrangements for their ongoing care.

Why It Matters

Without a clear plan, pets can end up in shelters or with people who may not understand their needs. A written pet care plan ensures your animals are cared for by someone you trust, keeping them safe and loved even if you are no longer there.

Who It Is For

Anyone who has pets should create a pet care plan, especially if they live alone, have aging animals, or want to make sure their pets stay with specific friends or family members.

Estate Organization System

What It Is

An estate organization system brings all your important documents, instructions, and information together in one easy-to-find place. It can include physical binders, digital files, or a combination of both, designed to guide your loved ones through your plans.

Why It Matters

Even the best documents are useless if no one knows where to find them. A clear organization system makes it easier for your family to handle your affairs with less confusion, less delay, and much less stress during an already difficult time.

Who It Is For

Everyone should create an estate organization system, especially those with multiple accounts, properties, businesses, or detailed personal wishes that need to be carried out carefully.

Frequently Asked Questions

Wondering why organization matters so much? Here are quick answers about how comprehensive planning makes all the difference.

Disclaimer: The information provided on this website and by Buried in Work is for general informational purposes only and should not be considered legal advice. Please consult with a qualified attorney or subject matter expert for advice specific to your situation.