Income now, impact later.

The Charitable Remainder Trust (CRT) Information Hub

A Charitable Remainder Trust (CRT) is like a financial mullet: business in the front, charity in the back. It lets you turn appreciated assets into income you can use now, while earmarking the remainder for a cause you care about. Whether you’re eyeing a tax-smart exit from stock or real estate or planning to leave a legacy that lives on, this might be the tool you didn’t know you needed.

Key Things To Know

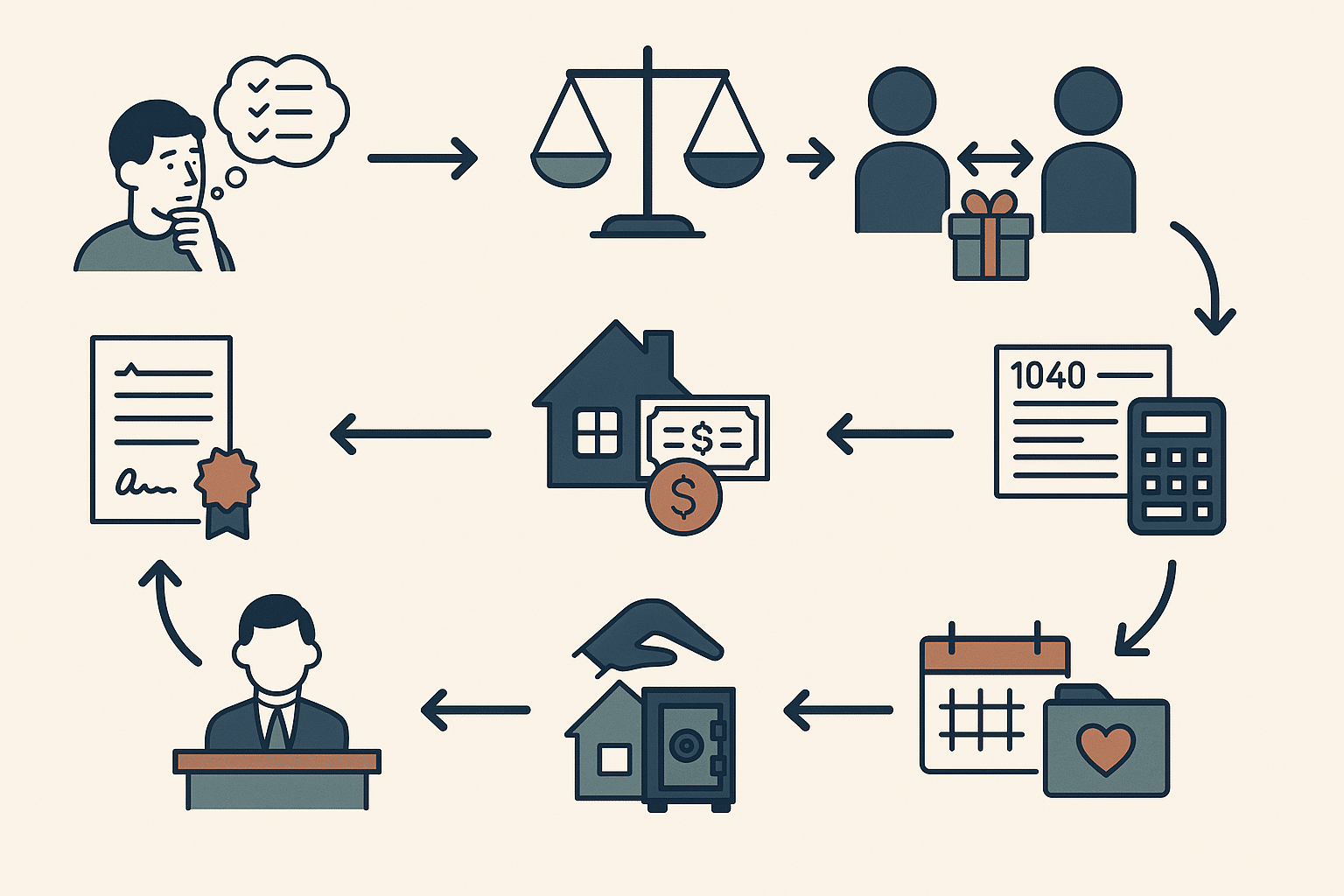

Setting up a Charitable Remainder Trust is not something you do on a whim. Here are the essentials you need to understand before you dive in.

- What is a Charitable Remainder Trust (CRT)?: A CRT is a split-interest trust: you (or someone you choose) get income now, and a charity gets what's left later. It’s a way to support a cause while keeping cash flow.

- CRUT vs. CRAT: Pick Your Flavor: You can set up a unitrust (CRUT) that pays a percentage of the trust value (recalculated annually), or an annuity trust (CRAT) that pays a fixed amount every year. Think flexible smoothie vs. consistent latte.

- Tax Breaks Galore: With a CRT, you may get an immediate charitable deduction, bypass capital gains on the donated asset, and reduce estate taxes. Plus, you’re spreading out income, which might lower your tax bracket.

- Ideal Assets to Donate: Appreciated real estate, stocks, or even crypto (if handled carefully). Don’t use cash if you're trying to avoid capital gains — you won’t be unlocking the main benefit.

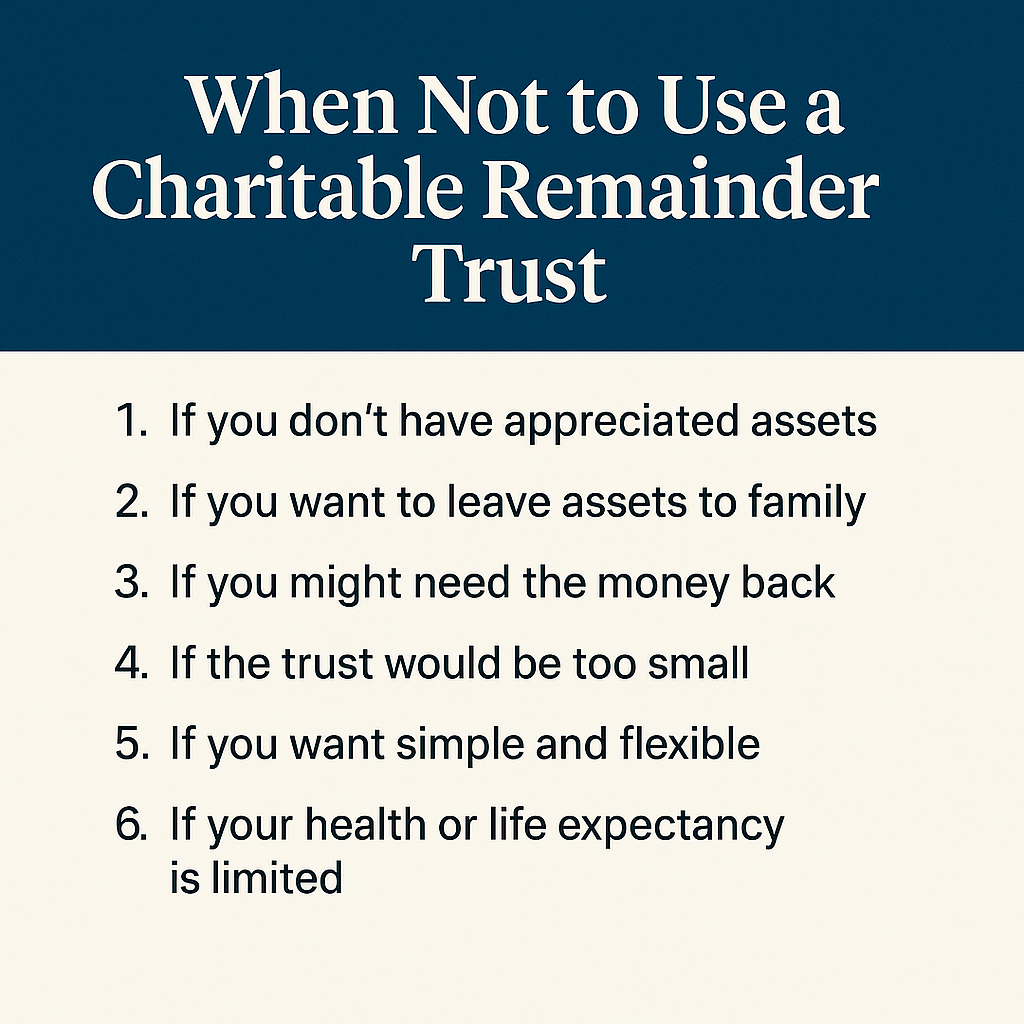

- Who Should Consider One?: People with appreciated assets, philanthropic goals, and a desire for lifetime income. It’s also great for folks planning for retirement or looking to diversify away from concentrated holdings.

- CRTs Are Irrevocable: Once it's in the trust, it's in the trust. You can't take it back. That’s good for commitment, but not so great if you’re the type who returns gifts after the holidays.

- Setup & Admin Isn’t DIY: You’ll need legal, tax, and potentially investment advisors. A CRT is powerful, but it comes with rules, paperwork, and required annual filings.

Articles

Frequently Asked Questions

Charitable Remainder Trusts can feel complicated, but they don’t have to be confusing. Below are some of the most common questions people ask once they start exploring whether a CRT makes sense for their legacy, finances, and goals.

Disclaimer: The information provided on this website and by Buried in Work is for general informational purposes only and should not be considered legal advice. Please consult with a qualified attorney or subject matter expert for advice specific to your situation.