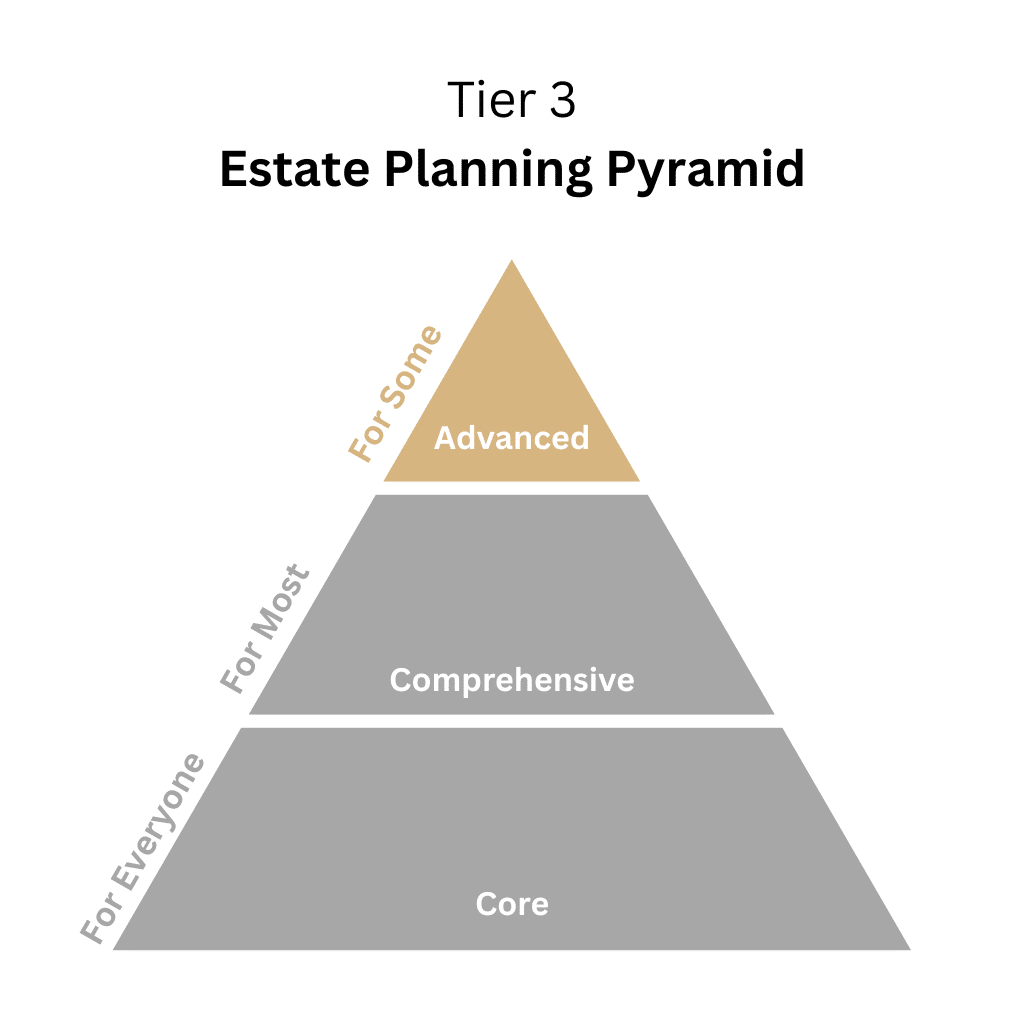

When your estate plan needs more than the basics, it is time to think bigger.

The Advanced Estate Planning Concepts Information Hub

Advanced estate planning goes beyond simple wills and powers of attorney. It focuses on protecting complex assets, handling special family situations, reducing taxes, and building legacies that last for generations. These strategies are not just for the wealthy. They are for anyone who needs to solve challenges that basic documents cannot cover alone.

Key Things To Know

When life, family, or finances get more complicated, your estate plan needs to keep up.

- Advanced planning is about control: It gives you more say over how your wealth, business, or legacy is handled across generations.

- You do not have to be ultra-wealthy to need advanced tools: Families with businesses, special needs children, or blended family dynamics often need extra strategies too.

- Taxes and probate can erode what you leave behind: Proper planning can help minimize both, keeping more in your family or in causes you care about.

- Trusts are not just for the rich: They can simplify asset transfers, protect heirs, and handle sensitive family situations discreetly.

- Advanced planning often builds flexibility into the future: Good strategies can adapt if family needs, laws, or financial situations change.

Key Documents And Planning Tools

Below you will find specialized strategies for protecting complex assets, unique family needs, and multi-generational legacies.

Trusts

What It Is

A trust is a legal arrangement where one person (the trustee) holds and manages assets on behalf of another person (the beneficiary). There are different types of trusts, such as revocable trusts, irrevocable trusts, and charitable trusts, each serving a unique purpose in estate planning.

Why It Matters

Trusts allow you to avoid probate, protect assets, and control how your wealth is distributed after you pass away. They also offer tax benefits and can provide ongoing financial support for your beneficiaries, such as children or charitable organizations. Additionally, trusts help ensure privacy by keeping your estate plan out of the public eye.

Who It Is For

Trusts are typically used by people with significant assets, complex estates, or special needs. If you own a business, have substantial real estate, or wish to control how your wealth is distributed over time, a trust can offer flexibility and long-term protection for your estate.

Donor Advised Funds

What It Is

A Donor Advised Fund (DAF) is a charitable giving vehicle that allows you to make a charitable donation, receive an immediate tax deduction, and then recommend how the funds are distributed to different charities over time. The fund is managed by a third-party organization, but you maintain control over the distributions.

Why It Matters

Donor Advised Funds provide a simple way to give to charity while receiving tax benefits. They allow you to plan your charitable giving over time and provide flexibility in how you support the causes you care about. DAFs also help reduce estate taxes by removing the donated assets from your taxable estate.

Who It Is For

DAFs are ideal for individuals or families who want to make charitable contributions over time, especially those who want to give to multiple charities or need a tax-efficient way to handle large charitable gifts. It’s also beneficial for people who want a hands-on approach to their giving without the administrative burden of a private foundation.

Family Foundations

What It Is

A family foundation is a nonprofit organization established by an individual or family to manage charitable donations. It allows you to direct your giving, involve multiple generations of your family, and make a long-lasting impact on the causes that matter most to you.

Why It Matters

Family foundations provide a way to create a structured, tax-efficient charitable giving strategy that can last for generations. They give you more control over how your donations are used, allow you to involve family members in philanthropic decisions, and offer significant tax benefits. Foundations can also build a lasting legacy of giving for future generations.

Who It Is For

Family foundations are typically used by high-net-worth individuals or families who want to create a lasting impact through charitable giving. They are ideal for families with substantial assets, philanthropic goals, and the desire to pass down charitable values.

Business Succession Planning

What It Is

Business succession planning outlines how ownership and control of a business will be transferred when an owner steps down, retires, or passes away. This plan includes identifying successors, outlining management transitions, and ensuring the continuity of business operations.

Why It Matters

Without a business succession plan, your business could face legal and financial turmoil upon your departure. A solid plan ensures that the business continues smoothly, preserves its value, and that your family or chosen successors are well-prepared to step into leadership roles.

Who It Is For

Business owners, especially those with significant business interests or family-run businesses, should have a succession plan. It is crucial for individuals looking to retire, pass their business to family, or ensure a seamless leadership transition for the future.

Charitable Remainder Trusts (CRTs)

What It Is

A Charitable Remainder Trust (CRT) is a trust that allows you to donate assets to charity while retaining the right to receive income from those assets during your lifetime or for a set term. After that, the remaining assets go to the designated charity.

Why It Matters

CRTs provide a way to give to charity while also receiving an immediate tax deduction. The income you receive from the trust can supplement your retirement, and because the charity receives the remainder, you reduce your taxable estate and minimize estate taxes.

Who It Is For

CRTs are ideal for individuals looking to make a significant charitable donation while benefiting from tax advantages. They are especially useful for high-net-worth individuals who have appreciated assets they wish to give to charity but still want to receive income during their lifetime.

Special Needs Trusts

What It Is

A Special Needs Trust (SNT) is designed to provide financial support for a person with disabilities without affecting their eligibility for government benefits like Medicaid or Supplemental Security Income (SSI). The trust can hold assets for the beneficiary while ensuring they can still access essential public assistance programs.

Why It Matters

Without a Special Needs Trust, a person with disabilities could lose access to important government benefits if they inherit assets or receive gifts. An SNT allows you to provide for their future needs while protecting their eligibility for these critical benefits.

Who It Is For

SNTs are vital for families with a loved one who has special needs or a disability. They ensure that the beneficiary can receive financial support without jeopardizing their access to vital public benefits that cover healthcare, housing, and other needs.

Frequently Asked Questions

Thinking about trusts, taxes, or bigger family plans? Here are quick answers about when advanced planning makes sense.

Disclaimer: The information provided on this website and by Buried in Work is for general informational purposes only and should not be considered legal advice. Please consult with a qualified attorney or subject matter expert for advice specific to your situation.