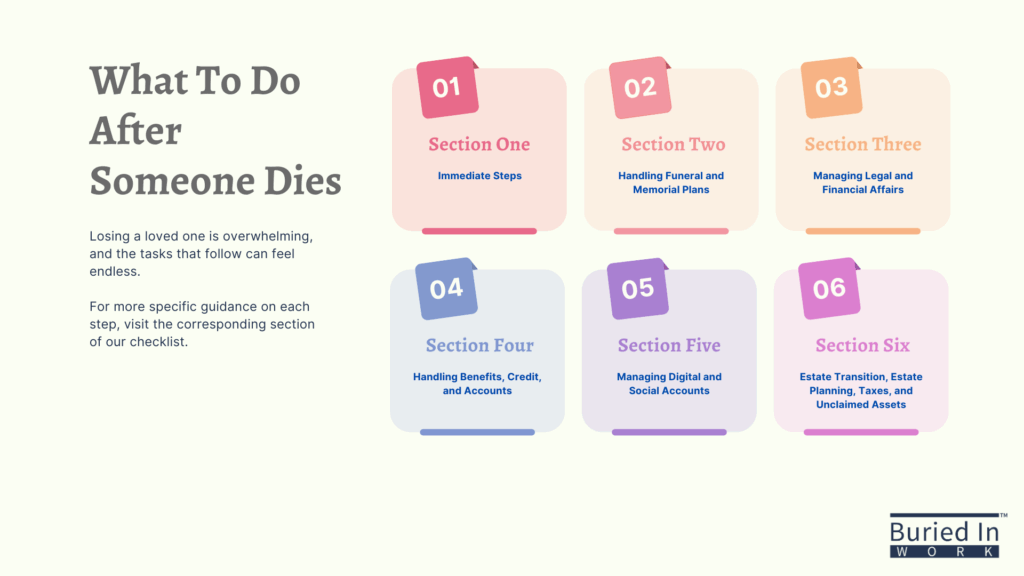

Checklist: What To Do After Someone Dies

Losing a loved one is overwhelming, and the number of tasks to handle afterward can feel daunting. This checklist walks you through the essential steps, ensuring everything is handled at the right time and in the right way.

You do not need to do everything at once. Take things step by step. If possible, delegate tasks to other family members or professionals to ease the burden.

Table of Contents

- Section 1: Immediate Steps (Within the First Few Days)

- Section 2: Handling Funeral and Memorial Plans

- Section 3: Managing Legal and Financial Affairs

- Section 4: Handling Benefits, Credit, and Accounts

- Section 5: Managing Digital and Social Accounts

- Section 6: Estate Transition, Estate Planning, Taxes, and Unclaimed Assets

Section 1: Immediate Steps (Within the First Few Days)

These first steps ensure that the proper authorities are notified, immediate needs are met, and the deceased’s home and belongings are secure.

If the person passed away at home, call 911 or their hospice provider to obtain an official pronouncement of death. If they passed away in a hospital or care facility, the staff will usually handle this.

How to do this:

- If the person passed away at home, call 911 or their hospice provider to obtain an official pronouncement of death.

- If they passed away in a hospital or nursing home, the staff will typically handle this.

- If suspicious circumstances are involved, the police or coroner may investigate.

Why it matters:

- The official time and cause of death must be documented for legal and medical records.

- Some deaths require an autopsy or investigation before proceeding with funeral arrangements.

- The pronouncement of death is necessary to obtain a death certificate, which will be required for handling legal, financial, and estate matters.

A doctor, nurse, or medical examiner will issue this document. It is required before obtaining an official death certificate, which you will need for legal and financial matters.

How to do this:

- A doctor, nurse, coroner, or medical examiner must confirm the death and issue a verification document.

- If the person was in hospice, a hospice nurse can provide this.

- Request multiple copies of the official death certificate from the funeral home or vital records office.

Why it matters:

- A death certificate is legally required for handling estate, financial, and insurance matters. Ensure that the state of residence is listed accurately on the death certificate in addition to where the passing occurred.

- Many institutions (banks, government agencies) require an original or certified copy before releasing information or assets.

- You will need several copies (typically 10–15), as different institutions require their own official copy.

How to do this:

- Check advance directives, or state donor registries to see if the deceased was an organ donor.

- If they were enrolled in a medical research or whole-body donation program, contact the appropriate institution immediately.

- If unsure, ask the hospital or hospice for guidance.

Why it matters:

- Organs must be retrieved quickly (often within hours) to be viable for transplantation.

- If they arranged for body donation, the program typically covers transportation and cremation costs.

- If donation is not pre-arranged, the family must decide quickly whether to approve it.

If no prearrangements were made, you will need to choose a funeral home, cremation service, or transport provider to move the body. If death occurred out of state, special transport may be required.

How to do this:

- If the person dies at home (expected death): A hospice nurse or attending physician will typically make arrangements with the pre-selected funeral home or cremation provider. If no provider is chosen, the family must contact one.

- If the person dies at home (unexpected death): Call 911. Emergency responders will determine if an investigation is needed. If no autopsy is required, a funeral home or mortuary must be contacted to transport the body.

- If the person dies in a hospital or nursing home: The facility’s staff will handle initial procedures and coordinate with the family’s chosen funeral home. If no arrangements were made, the family will need to select one.

- If the death occurs out of state or overseas: The family must hire a funeral home or transportation service that specializes in repatriation (body transport). The U.S. Embassy can assist with arrangements for international transport.

Why it matters:

- The body must be properly stored and cared for until burial or cremation.

- If death occurred in another location, transportation can be costly and complex, so early planning is critical.

- Some states require a transport permit before the body can be moved.

- In cases of suspicious or accidental death, a coroner or medical examiner may need to approve the release of the body before transport.

Reach out to immediate family first, then close friends. Consider appointing a trusted family member to help inform extended family and social contacts.

How to do this:

- Start by informing immediate family members before notifying extended relatives and close friends.

- If the loss is unexpected, have a trusted person help with phone calls or messages.

- Consider using a group message, social media post, or online memorial page for broader announcements.

Why it matters:

- Notifying loved ones helps provide emotional support and allows them to participate in funeral planning.

- Close family members may need to take time off work or make travel arrangements.

- In cases of estranged relationships, be thoughtful about who should be informed and how.

Lock doors and windows, take valuables to a secure location, and set up mail forwarding to prevent mail pile-ups that could attract criminals. If the home will be unoccupied, notify the local police or neighbors to keep an eye on the property.

How to do this:

- Lock all doors and windows to prevent break-ins.

- Remove valuables (jewelry, cash, important documents) and store them in a safe place.

- Set up mail forwarding to an executor or trusted family member to prevent identity theft.

- If the home will be vacant, notify local police or trusted neighbors to watch over the property.

Why it matters:

- An empty home can be a target for break-ins, squatters, or theft.

- Mail piling up can be a sign that no one is home, increasing security risks.

- Valuables need to be accounted for before probate or estate distribution begins.

If the deceased had minor children or dependent adults, ensure temporary care arrangements are in place while long-term guardianship is sorted out.

How to do this:

- If the deceased was responsible for minor children or dependent adults, arrange for temporary care with trusted family or friends.

- Review legal guardianship documents to determine who is the designated caregiver.

- If no guardian was named, the court may appoint one—contact a family law attorney for guidance.

Why it matters:

- Children and dependents should not be left without proper care, even temporarily.

- If no legal guardian is designated, custody disputes can arise.

- Certain benefits (Social Security, pensions) may transfer to dependents, so their needs must be legally addressed.

Make sure pets are fed and cared for. If no caregiver was designated in the will, arrange for a temporary foster or permanent home. Some pet charities offer rehoming services.

How to do this:

- Ensure pets have food, water, and immediate care.

- If no one can take them, place them in a boarding facility or foster home until permanent arrangements are made.

- Check the deceased’s will or pet trust to see if they designated a guardian or financial support for their care.

Why it matters:

- Pets can become neglected or abandoned if care arrangements are not made.

- Some states allow pet trusts, ensuring financial support for a pet’s lifetime care.

- If no guardian is designated, animal shelters or rescues may help with rehoming.

Remove perishable food, take out the trash, and ensure the home remains in good condition. If the deceased lived alone, consider having someone stay in the home temporarily.

How to do this:

- Dispose of food, take out trash, and check the fridge to prevent odors or pest issues.

- Turn off stoves, space heaters, and running faucets to avoid potential hazards.

- Ensure bills (electricity, water) remain paid if the home will stay occupied.

Why it matters:

- Unattended food can lead to rotting, mold, and pest infestations.

- Leaving the home unchecked could lead to frozen pipes, gas leaks, or fires.

- If the home remains occupied by another family member, they may need utilities updated in their name.

Section 2: Handling Funeral and Memorial Plans

Once immediate concerns are addressed, focus on funeral, burial, and memorial planning. If pre-arrangements exist, follow those instructions.

Locate the will, estate plan, or final wishes document. It may contain specific instructions for burial, cremation, or memorial services.

How to do this:

- Look for a will, advance directive, or funeral pre-planning documents in the deceased’s home, safe deposit box, or with an attorney.

- Check for pre-paid funeral or burial arrangements.

- If no written plan exists, the family will need to make funeral and burial/cremation decisions.

Why it matters:

- A will or advance directive may contain specific burial or cremation instructions, reducing stress on the family.

- Some prepaid funeral plans cover all or part of the costs, avoiding unexpected financial burdens.

- Without documentation, the next of kin must make all decisions, which can sometimes lead to disagreements.

If funeral arrangements were not pre-planned, you will need to choose a funeral home, burial site, or cremation provider. Consider cultural or religious traditions when making arrangements.

How to do this:

- Contact the funeral home, cremation provider, or cemetery to discuss options.

- Choose between burial, cremation, or an alternative final resting place.

- Schedule the funeral, memorial service, or celebration of life based on the deceased’s wishes or family preferences.

Why it matters:

- Some religions and cultures have specific timeframes for burial or cremation.

- If no pre-paid plan exists, funeral costs can be expensive—an average $7,000–$12,000 for a burial and $3,000–$6,000 for cremation.

- If there are disagreements about arrangements, a legal document stating the deceased’s wishes can resolve disputes.

Information Hub

Check if the deceased pre-wrote an obituary. If not, gather key biographical details, family names, and funeral details for submission to local newspapers or online platforms.

How to do this:

- Gather key details: full name, age, birth and death dates, immediate family members, career, accomplishments, and memorial details.

- Decide where to publish: local newspapers, online memorial sites, funeral home website, or social media.

- Submit the obituary at least a few days before the funeral if including service details.

Why it matters:

- Obituaries publicly honor the deceased and inform friends and extended family of the passing.

- Some insurance policies, veteran’s benefits, or legal matters may require a published obituary.

- Sharing online allows distant relatives and friends to pay respects and send condolences.

Information Hub

If the deceased was religious, notify their church, mosque, synagogue, or spiritual advisor to arrange any faith-based funeral services.

How to do this:

- Contact the church, synagogue, mosque, temple, or other spiritual group to inform them of the passing.

- Arrange for a priest, pastor, rabbi, imam, or other religious leader to lead the service if desired.

- If applicable, arrange religious customs (e.g., Catholic last rites, Jewish burial traditions, or Islamic Janazah prayers).

Why it matters:

- Many religious traditions require specific funeral rites or timing.

- Religious leaders often provide comfort and support to grieving families.

- Some places of worship offer free or low-cost funeral services for members.

Some cemeteries have specific guidelines for headstones. If cremation was chosen, decide on an urn, scattering, or columbarium placement.

How to do this:

- Check with the cemetery for rules on headstone size, material, and engraving requirements.

- If choosing cremation, select an urn, scattering service, or columbarium niche for storage.

- Consider ordering a memorial plaque or bench if burial isn’t planned.

Why it matters:

- Headstones and grave markers take weeks or months to produce, so ordering early is important.

- Cemeteries have strict regulations on marker types, sizes, and inscriptions.

- A personalized marker helps create a meaningful, lasting tribute to the deceased.

Information Hub

Section 3: Managing Legal and Financial Affairs

Once the funeral is planned, begin handling the deceased’s estate, including their financial, legal, and property matters.

Find wills, trusts, financial records, property deeds, and tax documents. If unsure, check the deceased’s files, safe deposit box, or digital storage.

How to do this:

Look for documents in file cabinets, safes, digital storage, or a safe deposit box such as:

- Death certificate copies (request at least 10–15)

- Financial records (bank accounts, retirement accounts, tax returns)

- Insurance policies (life, health, home, auto)

- Real estate deeds and mortgage documents

- Business ownership papers (if applicable)

Why it matters:

- These documents determine how assets are distributed and debts are settled.

- Many organizations (banks, insurance companies) will not release information without the correct documents.

- Having an organized folder saves time and effort during probate or estate administration.

Access requires proof of death and legal authorization. Some financial institutions require court orders or executor verification.

How to do this:

- Check the deceased’s records for a bank safe deposit box key or rental agreement.

- Contact the bank to see who is authorized to access it.

- If required, obtain a court order or notarized affidavit to gain access.

- Retrieve important documents, valuables, and heirlooms.

Why it matters:

- Wills, property deeds, and life insurance policies are often stored in safe deposit boxes.

- If no one else is listed on the box, access may be delayed due to legal requirements.

Information Hub:

Prevent mail pile-ups and identity theft by forwarding mail to the executor or a trusted family member. This ensures no important bills or legal notices are missed.

How to do this:

- Visit your local post office or go to the USPS website to request mail forwarding to an executor or trusted family member.

- Monitor mail for bills, financial statements, or other important correspondence.

Why it matters:

- Prevents identity theft, as thieves often target deceased individuals’ mail.

If renting, notify the landlord and arrange to clear out the property. If they had a mortgage, the executor must contact the lender to discuss payment and next steps.

How to do this:

- If renting, review the lease for early termination policies and coordinate a move-out plan.

- If the deceased owned a home with a mortgage, contact the loan servicer to discuss loan payments, refinancing, or selling.

Why it matters:

- Renters may avoid unnecessary rent payments if the lease can be terminated early.

- Mortgage lenders may allow a grace period before payments are due or offer options for survivors.

Contact providers for gas, water, electricity, phone, and internet. If the property will be unoccupied, ensure essential utilities remain on.

How to do this:

- Contact electricity, water, gas, phone, cable, and internet providers.

- Either transfer accounts to a new owner or cancel services if the home will be sold or vacated.

Why it matters:

- Prevents unnecessary charges and late fees.

- Ensures utilities remain active if the home is occupied or needs maintenance.

If the deceased owned property, notify insurance providers to keep coverage active until ownership is transferred.

How to do this:

- Contact the homeowner’s insurance company and notify them of the death.

- Ensure coverage remains active if the home is unoccupied (some insurers may require additional steps).

Why it matters:

- An unoccupied home may be considered high risk, and insurers may cancel or adjust the policy.

- Without coverage, damage from fires, theft, or weather events may not be covered.

Section 4: Handling Benefits, Credit, and Accounts

These steps help prevent fraud, settle outstanding debts, and ensure financial affairs are in order.

Social Security benefits do not automatically stop when someone passes away. If the deceased was receiving Social Security, it must be reported immediately to avoid overpayments, which the government may require to be repaid.

How to do this:

- If a funeral home is involved, they can often report the death on the family’s behalf. Confirm this with them.

- If not, call Social Security at 1-800-772-1213 or visit a local office to report the death.

- Provide the deceased’s full name, Social Security number, and a death certificate.

- If the deceased was receiving benefits, SSA will stop payments immediately to prevent overpayment.

Why it matters:

- If payments continue after the deceased’s death, SSA may require repayment.

- Surviving spouses, children, or dependents may be eligible for survivor benefits (see next step).

Information Hub:

Depending on eligibility, surviving spouses, children, and other dependents may qualify for Social Security survivor benefits. These benefits must be applied for—they are not automatically provided.

How to do this:

- Call Social Security (1-800-772-1213) or schedule an appointment at a local SSA office.

- Required documents:

- Death certificate

- Marriage certificate (for spouses)

- Birth certificates of dependent children

- Deceased’s Social Security number

Why it matters:

- Surviving spouses (age 60+ or 50+ if disabled) and dependent children may be eligible for monthly benefits.

- Survivor benefits help replace lost income for families.

Information Hub:

In addition to monthly survivor benefits, Social Security provides a one-time $255 death benefit to a surviving spouse or dependent child. This benefit is not automatic and must be claimed within two years of death.

How to do this:

- Call SSA at 1-800-772-1213 or visit a local office.

- Required documents:

- Death certificate

- Marriage certificate or proof of dependent relationship

Why it matters:

- This one-time $255 payment is only available to eligible spouses or children.

- The benefit does not transfer to other family members, so it must be claimed promptly.

Information Hub:

If the deceased was enrolled in Medicare, their benefits must be canceled to prevent fraud and billing errors. Medicare Part A and B are linked to Social Security and will stop automatically, but privately purchased plans (Medigap, Medicare Advantage, or Part D) must be canceled separately.

How to do this:

- Call Social Security (1-800-772-1213) to report the death and ensure Medicare A & B coverage is stopped.

- If the deceased had Medicare Advantage, Medigap, or Part D, contact the private insurer directly to cancel.

Why it matters:

- Prevents fraudulent use of the deceased’s Medicare number.

- Ensures surviving spouses update their own coverage if previously enrolled together.

If the deceased was a veteran, their family may be eligible for burial benefits, funeral assistance, survivor pensions, or military honors. The VA must be notified to process these benefits.

How to do this:

Call the VA at 1-800-827-1000 or visit a VA office. You can apply for:

- Burial benefits (funeral cost assistance, headstones, military honors)

- Survivor benefits (Dependency and Indemnity Compensation or VA pensions)

- If applicable, schedule a military funeral service with honors.

Why it matters:

- Veterans may be eligible for free burial in a national cemetery and financial assistance for funeral costs.

- Surviving spouses may qualify for monthly VA benefits, which can help replace lost income.

Information Hub

The deceased may have had pensions, final paychecks, life insurance, or stock benefits through their employer. These must be claimed by the designated beneficiaries.

How to do this:

- Contact the HR department or benefits administrator at the deceased’s last place of employment.

- Request information about:

- Final paychecks, pensions, or retirement accounts

- Employer-sponsored life insurance payouts

- Stock options or profit-sharing plans

Why it matters:

- Some company benefits expire if claims are not filed promptly.

- Employer-sponsored life insurance policies often provide significant financial support for survivors.

If the deceased had a pension, IRA, or 401(k), beneficiaries need to determine how funds will be distributed and whether a spousal rollover is possible.

How to do this:

- Contact the pension provider or financial institution to discuss payout options.

- Review 401(k), IRA, or annuity documents to determine the best way to access or transfer funds.

- If applicable, surviving spouses may have the option to roll over accounts into their own name.

Why it matters:

- Beneficiaries may need to take Required Minimum Distributions (RMDs) to avoid tax penalties.

- Some pension plans offer survivor benefits, but they must be claimed before a deadline.

How to do this:

- Contact each financial institution where the deceased held accounts.

- Provide a death certificate and request account closure or transfer to beneficiaries.

- Locate and handle safe deposit boxes (court orders may be required for access).

Why it matters:

- Prevents unauthorized access or fraud.

- Ensures estate funds are properly distributed to beneficiaries.

Information Hub

A deceased person’s identity can be stolen if their credit file remains active. To prevent fraud, their credit must be flagged as “Deceased.”

How to do this:

- Contact Experian, Equifax, or TransUnion and request a deceased alert on the credit file.

- Provide a death certificate and request a copy of the credit report to identify open accounts.

Why it matters:

- Prevents identity theft and fraudulent accounts from being opened in the deceased’s name.

- Helps identify outstanding debts or credit obligations.

Information Hub

Credit card accounts remain open unless the issuing bank is notified. To prevent fraud and avoid unnecessary fees, they should be closed as soon as possible.

How to do this:

- Contact each credit card company with a copy of the death certificate.

- Pay off any remaining balances or check for credit life insurance coverage (some accounts may be paid off upon death).

- Request a final account statement for estate settlement.

Why it matters:

- Open credit cards can still accrue charges, fees, or fraud if not closed properly.

- Some credit life insurance policies pay off balances, reducing estate liabilities.

Information Hub

Section 5: Managing Digital and Social Accounts

In today’s world, many people leave behind important digital assets. These can include email accounts, social media profiles, online banking, and digital subscriptions. Securing these accounts helps prevent identity theft, unauthorized access, and ongoing charges.

The deceased may have had valuable online accounts, including email, cloud storage, cryptocurrency, or online banking. These accounts may contain sensitive information or assets that need to be accessed, transferred, or closed.

How to do this:

- Check for password managers, notebooks, or stored login credentials for important accounts.

- Look for subscription services (Netflix, Spotify, Amazon Prime, meal delivery, cloud storage, etc.) that need to be canceled.

- If necessary, work with a digital executor (if designated in the will) or the estate executor to gain access.

Why it matters:

- Some digital assets have monetary value (cryptocurrency, NFTs, domain names, or online businesses).

- Prevents ongoing subscription charges that could accumulate on the deceased’s credit card.

- Protects sensitive personal data from being accessed by unauthorized individuals.

Information Hub

Most social media platforms allow you to delete or memorialize accounts:

- Facebook & Instagram – Can be deleted or turned into a memorialized profile.

- LinkedIn – Offers an option to close an account due to death.

- X/Twitter, TikTok, and Other Platforms – Each has its own process for handling deceased accounts.

Information Hub

Email accounts often hold important financial records, passwords, and personal communications. Gaining access or closing the account prevents misuse and ensures the estate has access to important documents.

How to do this:

- If possible, use stored passwords or a password manager to log in and update settings.

- Set an auto-reply message to inform contacts that the account is no longer in use.

- If access is unavailable, contact the email provider (Google, Yahoo, Outlook, etc.) to request account closure.

Why it matters:

- Many online accounts are linked to email, and email access is often required to reset passwords.

- Prevents email hacking, fraud, and phishing scams using the deceased’s account.

- Some accounts (like Gmail) allow trusted contacts to gain limited access with prior authorization.

Some digital assets, such as cryptocurrency wallets, domain names, digital artwork (NFTs), and online businesses, can hold significant value. Identifying and securing these assets ensures they are properly transferred.

How to do this:

- Look for cryptocurrency wallets (hardware wallets, Coinbase, Binance, etc.) that may require a private key to access.

- Identify domain names registered in the deceased’s name and renew or transfer ownership before expiration.

- Check for PayPal, Venmo, Cash App, or online stock trading accounts that may contain funds.

Why it matters:

- Cryptocurrency can be permanently lost if the private key is unavailable.

- Domain names may have financial or sentimental value (especially for business owners).

- Unclaimed digital funds may eventually be turned over to state unclaimed property offices.

The deceased may have ongoing monthly or yearly subscriptions that will continue billing unless canceled. Reviewing their accounts prevents unnecessary charges.

How to do this:

- Review credit card or bank statements for recurring payments.

- Cancel accounts such as:

- Streaming services (Netflix, Hulu, Disney+)

- News subscriptions (The New York Times, The Wall Street Journal)

- Meal delivery services (HelloFresh, Blue Apron)

- Online memberships (Amazon Prime, Costco, gym memberships)

- Some accounts may require proof of death or the executor’s authorization to cancel.

Why it matters:

- Prevents unnecessary financial drain on the estate.

- Some services auto-renew annually, leading to unexpected charges.

- Cancelling unused subscriptions simplifies the estate settlement process.

Section 6: Estate Transition, Estate Planning, Taxes, and Unclaimed Assets

After handling immediate financial, legal, and digital matters, the next step is ensuring that the estate is properly settled. This includes determining whether probate is required, filing necessary tax returns, and updating your own estate plans.

Probate is the legal process of settling a deceased person’s estate, which includes distributing assets and paying debts. Whether probate is required depends on state laws, the size of the estate, and whether assets were jointly owned or had named beneficiaries.

How to do this:

- Check if the deceased had a will or trust. If a trust was properly funded, probate may not be necessary.

- Determine if the estate qualifies for small estate procedures, which may avoid formal probate.

- If probate is required, the executor must file the will with the local probate court and begin the process.

- Consult with an estate attorney to understand state-specific rules and timelines.

Why it matters:

- Probate can be time-consuming and costly, but some estates qualify for simplified probate.

- If probate is required, it must be started before assets can be legally distributed.

- Knowing whether probate is necessary helps set expectations for how long estate settlement will take.

Information Hub

Many people leave behind unclaimed assets such as old bank accounts, insurance payouts, security deposits, and uncashed checks. These assets may be recoverable through state unclaimed property databases.

How to do this:

- Search for unclaimed property using both federal and state databases.

- Check with former employers, insurance companies, and financial institutions for unpaid benefits.

- If unclaimed assets are found, follow the state’s process for submitting a claim, which may require a death certificate and proof of executor status.

Why it matters:

- Millions of dollars in unclaimed assets go uncollected each year due to families being unaware of them.

- Beneficiaries may be entitled to lost funds that could help with estate expenses.

- Some states turn over unclaimed property to the government after a certain period, making it harder to recover later.

Information Hub

A final tax return must be filed for the deceased for the year they passed away. If the estate earns income after their death, an estate tax return may also be required.

How to do this:

- File the final personal income tax return (Form 1040) by April 15 of the following year.

- If the estate earns more than $600 in income (e.g., from rental property or investments), file an estate income tax return (Form 1041).

- If the estate’s total value exceeds the federal estate tax exemption ($13.61 million for 2024), file a federal estate tax return (Form 706) within 9 months of death.

- Work with an estate attorney or tax professional to ensure compliance with federal and state laws.

Why it matters:

- Failure to file taxes can result in penalties and legal complications for the executor.

- Some medical expenses and funeral costs may be deductible on the final return.

- If the deceased was due a tax refund, beneficiaries may need to file Form 1310 to claim it.

Information Hub

The death of a loved one is a reminder to update your own estate plan to reflect life changes. This ensures that your wishes are documented and your loved ones are prepared.

How to do this:

- Review and update your will and trust to reflect any changes in beneficiaries or named executors.

- Update your power of attorney, healthcare proxy, and advance directives if necessary.

- Check life insurance policies and retirement accounts to ensure beneficiary designations are correct.

- Consider discussing estate plans with trusted family members to ensure they understand your wishes.

Why it matters:

- Outdated estate plans can lead to confusion, disputes, or unintended heirs.

- If a deceased loved one was a beneficiary or executor in your will, updates may be necessary.

- Having a clear estate plan reduces the burden on family members during difficult times.

If probate is not required, or after probate has been completed, the next step is administering the estate and closing it. This involves distributing assets, paying debts, and ensuring all necessary legal and financial steps are completed.

How to do this:

- Distribute Assets: Once debts are paid and taxes filed, the executor or administrator can distribute the assets to the beneficiaries according to the will or state law.

- Pay Debts and Expenses: All outstanding debts, including funeral costs and any unpaid bills, must be paid before assets are distributed.

- Close Accounts and Contracts: Cancel any accounts or memberships in the deceased’s name and settle any contracts.

- File Final Tax Returns: Ensure all income taxes are filed, including for any estate taxes due.

- Get Court Approval (if needed): In some cases, the executor may need to get court approval to close the estate.

Why it matters:

- Proper administration ensures the estate is settled legally and efficiently.

- Closing the estate ensures that no further legal action is needed, and all assets are properly distributed.

- Closing the estate formally can also prevent any future claims against it.

Leave Your Heirs The Gift Of Organization With a CLEAR Kit

Did you know?

The average estate takes 570 hours to administer.

Related Content