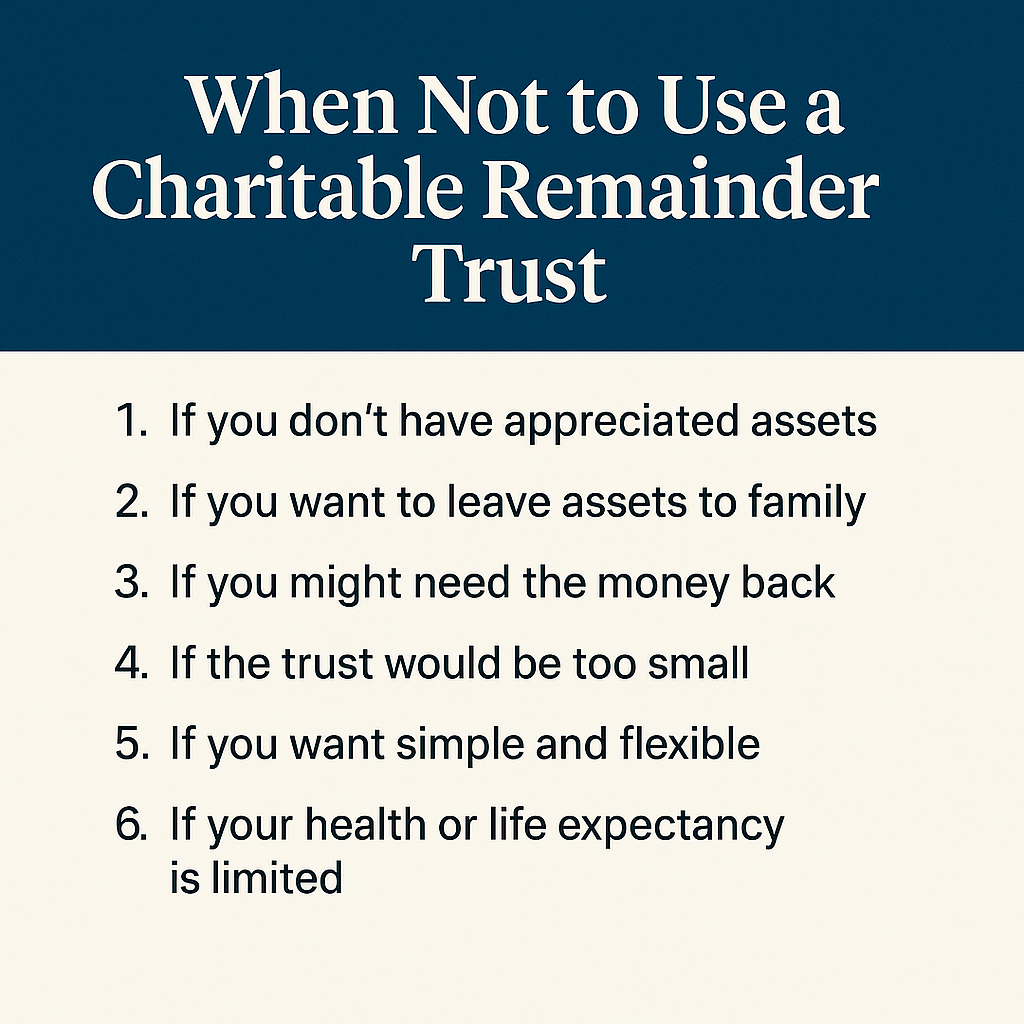

Charitable Remainder Trusts (CRTs) can be a smart way to turn appreciated assets into income, reduce taxes, and support causes you care about. But they’re not a one-size-fits-all solution. In fact, in the wrong situation, a CRT can cost you more in hassle, complexity, and missed opportunities than it’s worth.

Before you jump into setting one up, it’s just as important to know when a CRT might not be the right move.

If You Don’t Have Appreciated Assets

CRTs are designed to handle assets that have grown significantly in value. Think real estate you bought decades ago or stock in a company that’s done well over time. If you fund a CRT with cash or assets that haven’t appreciated, you won’t be unlocking the main tax advantage — avoiding capital gains.

In those cases, other charitable giving tools may be simpler and more effective.

If You Want to Leave Assets to Family

Remember, a CRT is ultimately a charitable vehicle. Once the trust ends, the remaining funds go to charity — not to your children, spouse, or other family members (unless they are income beneficiaries during the trust term).

If your primary goal is to pass wealth to your heirs, you may want to consider other estate planning strategies such as irrevocable trusts, life insurance plans, or direct gifting.

If You Might Need the Money Back

A CRT is irrevocable. Once you place assets in the trust, they no longer belong to you. You can’t pull them back out, and you have limited control over how the funds are used after the trust ends.

If there’s any chance you’ll need access to the principal in the future — for healthcare costs, long-term care, or financial security — a CRT may create more risk than reward.

If the Trust Would Be Too Small

While there is no legal minimum size for a CRT, most experts recommend starting with at least $250,000 in assets. That’s because the legal fees, annual tax filings, and investment oversight come with real costs.

If the trust is too small, those fees can eat into your returns and reduce the remainder that goes to charity. A donor advised fund or a simple outright gift might be more cost-effective for smaller donations.

If You Want Simple and Flexible

CRTs require annual administration, IRS filings, investment management, and trust compliance. You’ll need a qualified trustee and possibly a financial advisor or attorney to keep things running smoothly.

If you prefer simplicity and want the freedom to change your mind later, a donor advised fund may offer more flexibility with far less paperwork.

If Your Health or Life Expectancy Is Limited

CRTs work best when they have time to grow. If the trust only runs for a few years before the payout to charity, the tax deduction and overall benefit may be smaller than expected.

In those cases, a direct charitable gift or a plan built around lifetime giving might make more sense.

If You’re Expecting Big Expenses Soon

CRTs are long-term vehicles. They are not built to handle short-term cash needs. If you’re planning a move, funding a large purchase, or paying off major debts, setting aside income-generating assets in a CRT might limit your financial flexibility right when you need it most.

Final Thoughts

Charitable Remainder Trusts are powerful tools — in the right hands, at the right time. But they are not always the best fit. Before you commit to one, make sure your financial situation, legacy goals, and charitable intent all align.

There are plenty of ways to support good causes. A CRT is just one of them. And knowing when to pass on it can be just as valuable as knowing when to say yes.

Key Takeaways

-

CRTs are best for appreciated assets, not cash or low-gain investments

-

You cannot reclaim funds once they’re placed in the trust

-

CRTs are not ideal for passing wealth to heirs

-

Small trusts may not be cost-effective after fees and filings

-

Other tools may work better if you need flexibility or short-term liquidity

If you have feedback, questions, or ideas for future articles or Information Hubs, please contact us. Your insights help us create valuable content.