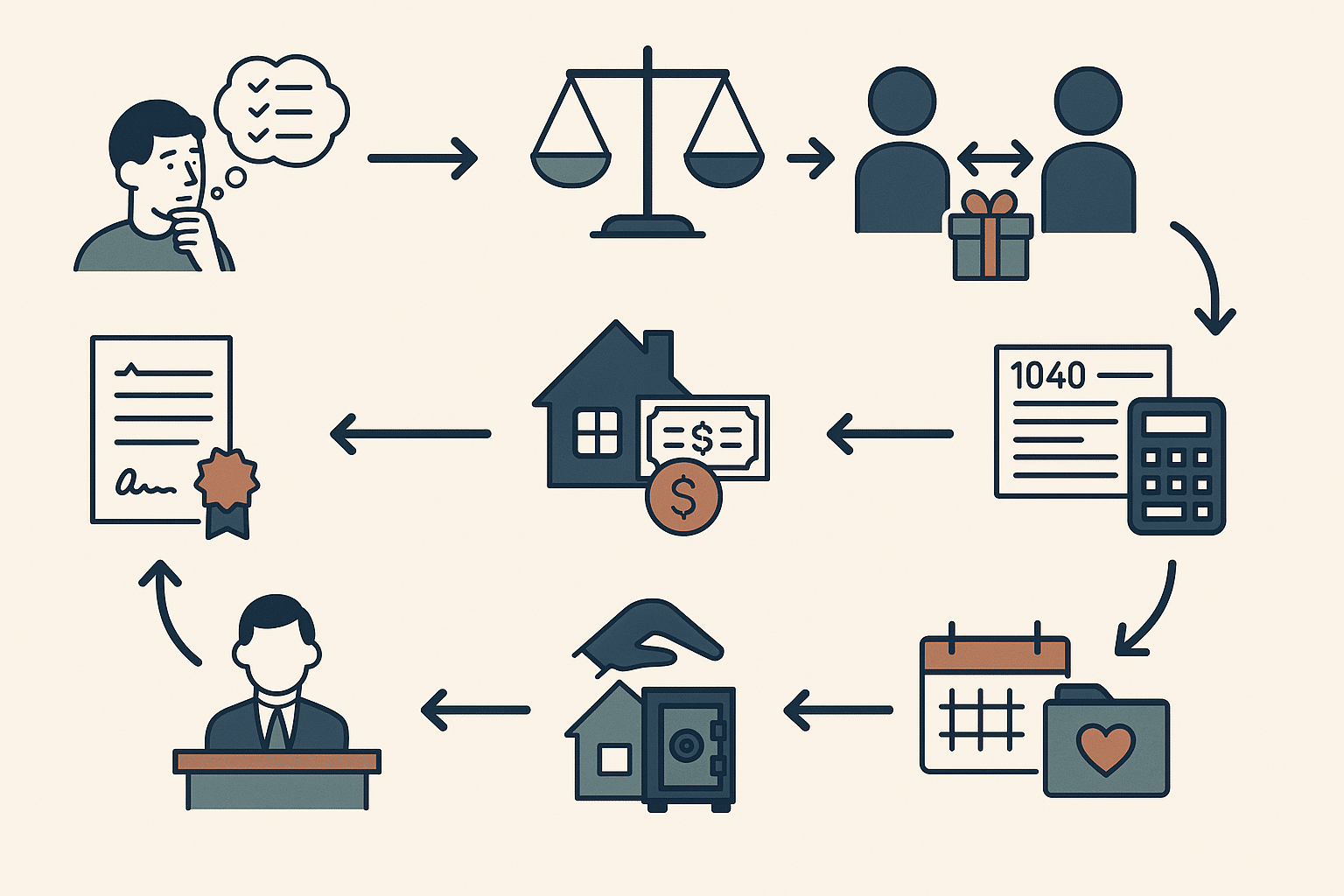

Setting up a Charitable Remainder Trust (CRT) is not something you do overnight, but it is more approachable than many people think. With the right guidance, this powerful tool can help you avoid capital gains taxes, generate lifetime income, and support the causes you care about.

If you’re considering a CRT, here’s a simple step-by-step walkthrough to help you understand how the process works from start to finish.

Step 1: Define Your Goals

Before drafting anything, it’s important to clarify what you want the CRT to accomplish. Some of the key questions to ask yourself include:

-

Do you need income for life or for a fixed term?

-

Are you trying to avoid capital gains on appreciated assets?

-

Do you want to leave a legacy gift to a specific charity or a flexible giving structure?

-

Will the income go to just you, or to someone else as well?

Having a clear purpose up front will shape the design of the trust.

Step 2: Choose the Right Type of CRT

There are two main types of Charitable Remainder Trusts:

Charitable Remainder Unitrust (CRUT):

Pays a fixed percentage of the trust’s value each year, recalculated annually. This means income can go up or down depending on performance.

Charitable Remainder Annuity Trust (CRAT):

Pays a fixed dollar amount each year, regardless of how the assets perform.

CRUTs are more flexible, especially if you plan to add assets over time. CRATs offer predictable income, which some people prefer in retirement.

Step 3: Select the Asset You Will Donate

You can fund a CRT with a variety of assets, but the most common choices include:

-

Appreciated stock

-

Real estate (debt-free)

-

Business interests

-

Cryptocurrency (if properly handled)

It’s critical that the asset has not already been sold. If you contribute something that’s already under contract, the IRS may treat it as a taxable event.

Step 4: Choose the Income Beneficiaries

You can name yourself, your spouse, another family member, or even a friend to receive income from the trust. You can also set it up to last for joint lifetimes or a set number of years (up to 20).

Keep in mind that the more people you include, the more complex the trust becomes — and the lower your charitable deduction may be.

Step 5: Name the Charitable Beneficiary

This is the organization that will receive whatever is left in the trust when it ends. You can name a specific nonprofit, a religious institution, a university, or a donor advised fund or family foundation.

Some people keep this flexible by allowing the trustee to select a charity later, or by naming a fund where family members can help recommend grants.

Step 6: Work with an Attorney to Draft the Trust

CRTs are legal instruments with specific requirements to maintain tax-exempt status. You will need an attorney with experience in charitable planning or estate law to create the trust document.

At this stage, you’ll define:

-

How the income is calculated

-

Who the beneficiaries are

-

Who the trustee will be

-

The rules for managing and distributing assets

This document must comply with IRS regulations, or you risk losing the tax advantages.

Step 7: Appoint a Trustee

The trustee is the person or institution responsible for managing the trust, handling investments, and making distributions. This could be:

-

You (with professional help)

-

A financial institution or trust company

-

An attorney or CPA

-

A combination of people and professionals

Choose someone who is capable and trustworthy, as they will have a long-term role in managing the trust properly.

Step 8: Transfer the Assets to the CRT

Once the trust is set up and the trustee is ready, you will formally transfer the selected assets into the CRT. This is when the tax benefits begin.

The trust becomes the legal owner of the assets. If the asset is then sold, the CRT pays no capital gains tax, and the full proceeds can be reinvested to support your income stream.

Step 9: File IRS Forms and Take the Deduction

In the year you fund the CRT, you are entitled to a charitable deduction based on the present value of the remainder interest going to charity. This amount is calculated using IRS formulas based on interest rates, term length, and expected income payouts.

Your advisor or accountant will help you file the proper forms and determine how much of the deduction you can claim in the current year or carry forward.

Step 10: Manage and Maintain the Trust

From here, the trustee is responsible for:

-

Making regular income distributions

-

Filing annual tax returns for the trust

-

Keeping records of transactions and performance

-

Ultimately distributing the remainder to charity when the trust ends

Many trustees hire a CPA or investment manager to assist with these duties.

Final Thoughts

Setting up a Charitable Remainder Trust takes planning, but the benefits are significant. With the right structure in place, you can avoid large tax bills, generate stable income, and leave a lasting charitable impact.

Work with professionals who understand both the legal and financial sides, and you can build a trust that supports you now and creates purpose long after you’re gone.

Key Takeaways

-

CRTs provide income now and a charitable gift later

-

You can choose between CRAT or CRUT depending on your income goals

-

Donated assets must not be under contract or encumbered by debt

-

Professional drafting and trust administration are essential

-

The process involves legal, tax, and financial coordination

If you have feedback, questions, or ideas for future articles or Information Hubs, please contact us. Your insights help us create valuable content.