For most people, Social Security is a major piece of retirement income. But when and how you claim your benefit can be the difference between a comfortable retirement and one filled with financial surprises. With over 2,700 rules in the Social Security system, it’s easy to make a misstep, especially without guidance.

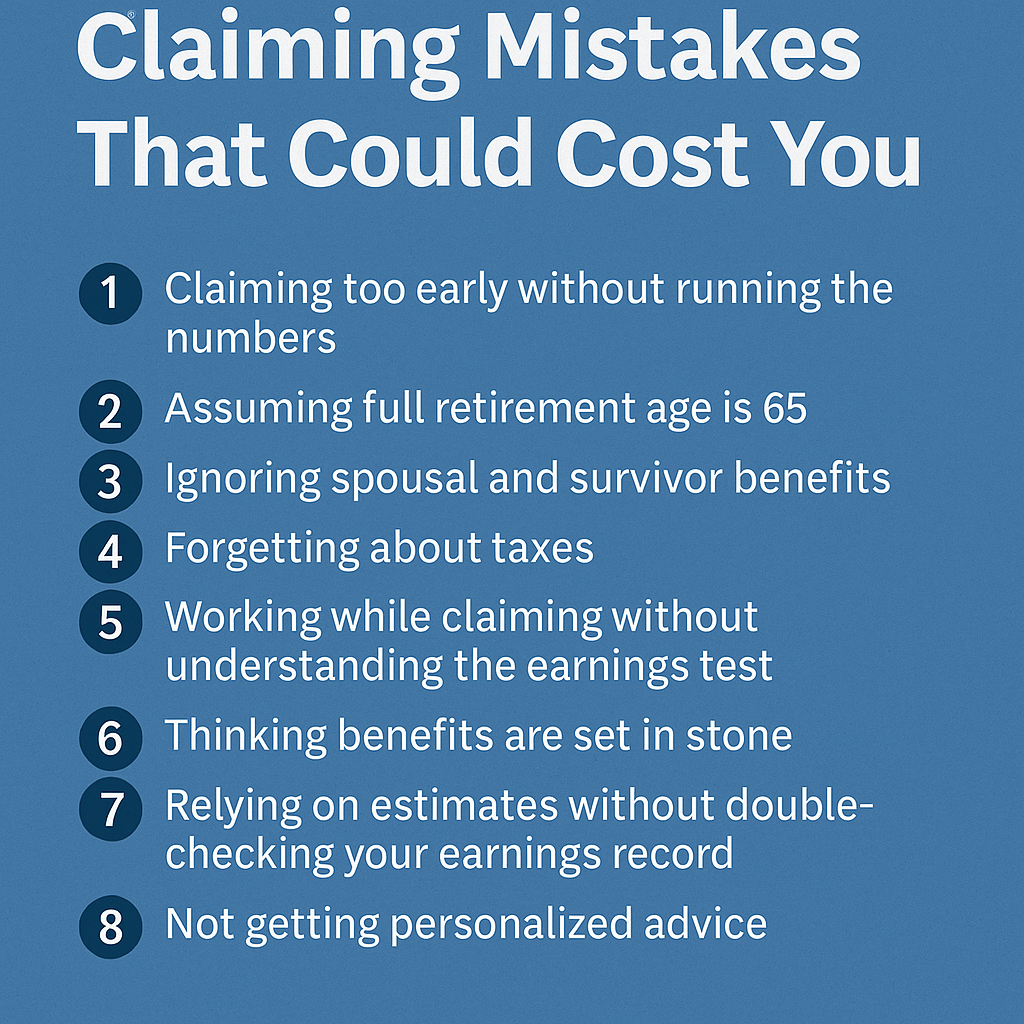

Let’s walk through eight of the most common (and costly) mistakes people make when claiming Social Security, and how to avoid them.

1. Claiming too early without running the numbers

You can start collecting benefits as early as age 62, but that comes with a permanent reduction. If you live a long life, you could leave tens of thousands of dollars on the table. Before claiming early, weigh the tradeoff between starting sooner and collecting less.

2. Assuming full retirement age is 65

This one trips up a lot of people. Full retirement age is based on your birth year. For most people today, it falls between 66 and 67. Claiming before that age reduces your benefit, and claiming after increases it. Know your specific full retirement age before making any decisions.

3. Ignoring spousal and survivor benefits

If you’re married or were married for at least 10 years, you may qualify for spousal or survivor benefits that could be more than your own. Many people don’t realize these benefits exist or misunderstand how to claim them. You could be eligible for up to 50 percent of your spouse’s benefit, or 100 percent of their benefit if you’re a surviving spouse.

4. Forgetting about taxes

Social Security might not be entirely tax-free. If your combined income (Social Security plus other income sources) crosses certain thresholds, up to 85 percent of your benefit may be subject to federal income tax. Coordinating your withdrawals, income, and benefits matters more than you think.

5. Working while claiming without understanding the earnings test

If you collect benefits before your full retirement age and still work, you may have part of your benefit withheld if you earn above a certain limit. The Social Security earnings test catches many people off guard. You’ll get the money back later, but it’s not ideal if you’re counting on a consistent monthly check.

6. Thinking benefits are set in stone

Once you start collecting, your options become more limited, but not entirely gone. You can withdraw your application and repay benefits within 12 months of starting. Or you can suspend benefits after reaching full retirement age to earn delayed credits. But if you don’t know your options, you may lose valuable flexibility.

7. Relying on estimates without double-checking your earnings record

Your benefit is calculated based on your highest 35 years of earnings. If there are gaps, errors, or low-earning years that don’t reflect your actual work history, your benefit could be lower than it should be. It’s easy to check and correct your earnings record at SSA.gov, and it’s worth doing early.

8. Not getting personalized advice

Every household’s financial picture is different. The right claiming strategy depends on your health, income needs, marital status, tax situation, and long-term goals. What worked for your neighbor or coworker may not be right for you. Getting advice from a financial planner or Social Security specialist can help you avoid costly mistakes.

Bottom line

Social Security is more than just a monthly check. It’s a complex system with rules that can help or hurt you depending on how well you understand them. These eight common mistakes don’t just impact your monthly benefit. They can affect your taxes, your spouse’s benefits, and your overall retirement income.

Take the time to get it right. The difference could be worth thousands.

If you have feedback, questions, or ideas for future articles or Information Hubs, please contact us. Your insights help us create valuable content.