Plan with care for the lifelong needs of your loved one.

The Special Needs Information Hub

Supporting a loved one with special needs involves thoughtful planning around finances, caregiving, benefits, and long-term legal protections.

Key Things To Know

Planning for a loved one with special needs requires balancing care, independence, and long-term financial and legal protections—while preserving access to essential benefits.

- A Special Needs Trust (SNT) helps preserve eligibility for public benefits: Assets placed in an SNT don’t count against income or resource limits for programs like SSI and Medicaid.

- There are different types of trusts for different situations: First-party trusts use the individual's own assets (often from a settlement or inheritance), while third-party trusts are funded by parents or loved ones.

- ABLE accounts are another planning tool: These tax-advantaged savings accounts allow individuals with disabilities to save money for qualified expenses without losing benefits.

- Guardianship or alternatives may be needed in adulthood: When a person with special needs turns 18, parents may need to pursue guardianship or consider less restrictive options like supported decision-making or power of attorney.

- A letter of intent can guide future caregivers: While not a legal document, this personalized letter helps explain your loved one’s routines, needs, preferences, and personality.

- Public benefits are a key part of many care plans: SSI, SSDI, Medicaid, and state waiver programs can help cover health care, housing, employment support, and daily living needs.

- Planning should include future housing and caregiving arrangements: Whether the goal is independent living, group housing, or co-residency, it’s important to start exploring options early.

- Sibling involvement is important to discuss: Clear communication about responsibilities, expectations, and available resources can help prepare for the future.

- Planning should be coordinated with your broader estate plan: A will, life insurance, and beneficiary designations should align with your special needs plan to avoid accidental disqualification from benefits.

Resources

Buried in Work offers a variety of checklists, guides, and other resources. Below are some of the most popular ones related to this information hub.

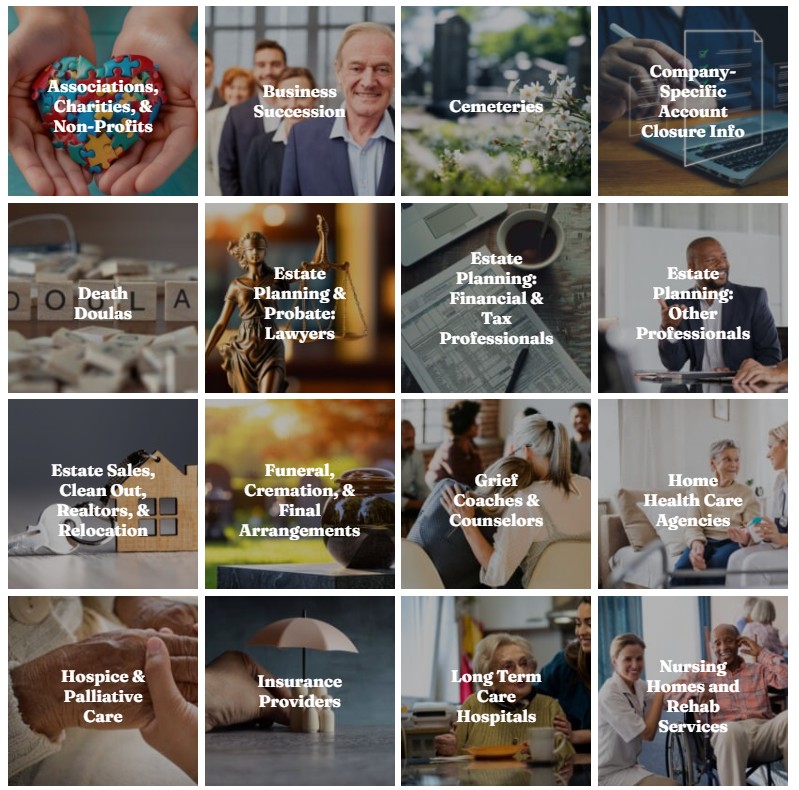

Find A Service Provider Near You

Need professional assistance? Use our directories to find trusted service providers near you who specialize in estate planning, end-of-life organization, and related services.

Articles

Frequently Asked Questions

Disclaimer: The information provided on this website and by Buried in Work is for general informational purposes only and should not be considered legal advice. Please consult with a qualified attorney or subject matter expert for advice specific to your situation.